The Republican Sweep Changes Everything For Morgan Stanley's Large-Cap Bank Thesis

The surprise election of Donald Trump may have been a game-changer for bank stocks. Morgan Stanley analyst Betsy Grasek has issued a wave of rating and price target changes for bank stocks.

Even following significant post-election run-ups, Morgan Stanley has upgraded Citigroup Inc (NYSE: C) to Overweight and State Street Corp (NYSE: STT) to Equal Weight.

“As we indicated in our September 2016 US Financials Election Note, A Republican sweep is positive for all financial stocks. More growth, higher rates, less regulation, lower taxes,” Grasek explained.

Analyst's Expectations

Grasek added that she expects many banks will be more aggressive in their capital return proposals as well.

She believes the post-election boost many bank stocks have gotten has priced in expectations of higher interest rates, but it still doesn’t reflect the potential of higher earnings growth and lower taxes. Morgan Stanley believes Republicans have a clear path to lowering the corporate tax rate to 20 percent.

Upgrades

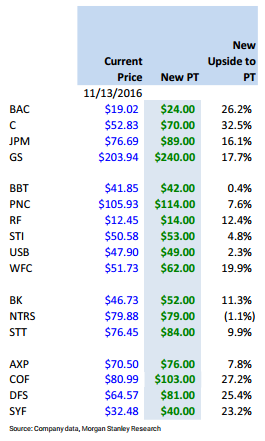

Morgan Stanley has upped its price targets across the board for 17 bank stocks under coverage, including the following:

- Bank of America Corp (NYSE: BAC).

- Citigroup.

- Goldman Sachs Group Inc (NYSE: GS).

- JPMorgan Chase & Co. (NYSE: JPM).

- State Street.

- Wells Fargo & Co (NYSE: WFC).

Downgrades

Despite price target hikes, the firm has downgraded the following to Underweight, given that the stocks are now trading near fair value:

3 In Focus

Based on the firm’s new price targets, the three bank stocks with the most upside remaining are Citigroup (32.5 percent), Capital One Financial Corp. (NYSE: COF) (27.2 percent) and Bank of America (26.2 percent).

All Changes

The full list of new price targets is included in the table below.

Disclosure: The author is long C.

Image Credit: By Michael Vadon (Own work) [CC BY-SA 4.0] via Wikimedia Commons

Latest Ratings for BAC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Baird | Upgrades | Underperform | Neutral |

| Jan 2022 | Morgan Stanley | Maintains | Underweight | |

| Jan 2022 | JP Morgan | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas News Upgrades Downgrades Price Target Politics Analyst Ratings Best of Benzinga