Analog Devices Retreats Hard From All-Time High After Q1 Beat

Analog Devices, Inc. (NASDAQ: ADI) stock exploded higher to new all-time highs Wednesday after the company reported a $0.19 EPS beat and a $109 million revenue beat in the first quarter. However, after peaking as high as $90.49 on its highest daily volume in nearly a year, Analog Devices performed a quick 180-degree turn, finishing Thursday’s session down 4.1 percent at $82.21.

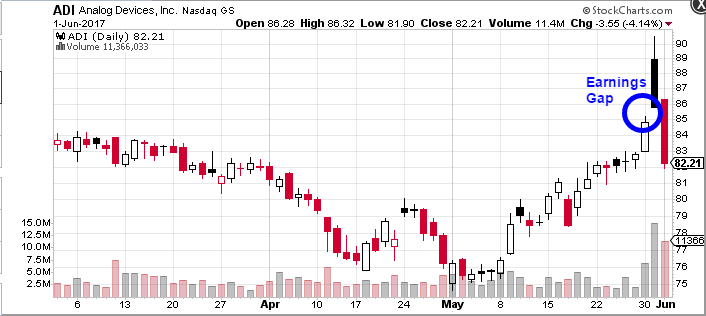

For investors left puzzled by the lack of follow-through after such a strong quarter, there may be a couple of market forces in play. First, from a technical perspective, the big earnings jump created a small gap in the stock’s chart in the $85–$86 range. The gap can be seen in the chart below.

Technical traders know that stocks tend to retrace and fill these gaps before resuming their previous trends, and Analog Devices wasted little time by filling that gap completely on Thursday.

Related Link: The Technician's Playbook: Exxon Mobil Revisits Long-Term Support Level

In addition to the gap fill, Analog Devices is likely experiencing some “sell the news” pressure, or profit taking, by bulls that have enjoyed the stock’s huge run in recent years. The stock is up 38.9 percent in the past year and 127.8 percent in the past five years. Traders anticipating a big first quarter from the company may have waited for the good news before collecting profits and moving on to another stock with a near-term catalyst.<?p>

Long-term investors should enjoy the strong quarter and not get too caught up in the short-term behavior of the stock.

“We continue to argue higher quality Rev, better growth and superior returns merit a premium multiple,” Credit Suisse analyst John Pitzersaid of Analog this week. Credit Suisse maintains an Outperform rating and $100 price target for the stock.

Joel Elconin contributed to this article.

______

Image Credit: By A. Milia - was sent to me personally, Public Domain, via Wikimedia Commons

Latest Ratings for ADI

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Citigroup | Maintains | Buy | |

| Jan 2022 | Barclays | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Earnings Long Ideas News Price Target Technicals Analyst Ratings Tech Best of Benzinga