Pricing Drives Margin In Micron's May Quarter

After reporting strong third-quarter earnings, Wells Fargo analyst David Wong expects Micron Technology, Inc. (NASDAQ: MU) to continue to perform well, as he reiterated his Outperform rating with a $40 price target.

Micron’s Earnings Highlights

- EPS: $1.62 versus $1.51 expected.

- Revenue: $5.57 billion versus $5.41 billion consensus.

- Sales: $5.566 billion (up 20 percent quarter over quarter and 92 percent year over year).

- Gross Margin: 46.9 percent (36.7 percent in Q2).

- Revenue Guidance: $5.7–$6.1 billion.

“Micron's May quarter results show strong revenue and gross margin momentum, with a further sequential rise in sales and improvement in gross margin expected in the upcoming quarter. The company appears to be benefiting from a favorable memory pricing environment, firm memory bit demand and lower costs from its technology transitions,” Wong said (see his track record here).

Additional earnings metrics are available on Benzinga Pro.

Overall, It is clear favorable pricing continues to help drive Micron, which is now seeing higher average prices for its chips. "The global trends taking shape today, including machine learning and big data analytics, are exciting and create significant opportunities for Micron," Micron President and CEO Sanjay Mehrotra said.

At time of publication, shares of Micron were down 3.97 percent at $30.22.

Related Links:

Micron Falling Ahead Of Q3 Report

Can Micron Beat The Street Again?

_______

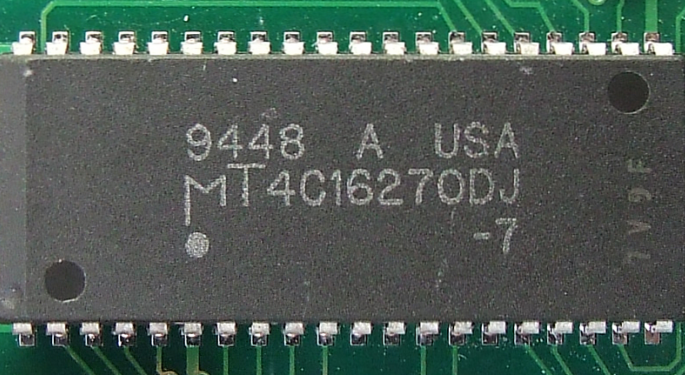

Image Credit: By Trio3D - Own work, CC BY-SA 3.0, via Wikimedia Commons

Latest Ratings for MU

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Wedbush | Upgrades | Neutral | Outperform |

| Jan 2022 | Goldman Sachs | Maintains | Buy | |

| Jan 2022 | New Street Research | Initiates Coverage On | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Earnings Long Ideas News Reiteration Analyst Ratings Movers Tech Best of Benzinga