Teladoc Is Poised To Benefit From Growth In Telehealth, Baird Says In Upgrade

Teladoc Health Inc (NYSE: TDOC) shares are likely to be beneficiaries of several upcoming positive catalysts and an attractive valuation, according to Baird.

The Analyst

Analyst Matthew Gillmor upgraded shares of Teladoc from Neutral to Outperform and maintained an $80 price target.

The Thesis

Baird continues to hold a bullish long-term view of the telehealth industry thanks to a confluence of secular drivers, Gillmor said in a Monday note.

Citing Teladoc, the analyst said plan sponsors as well as payers are reconfiguring benefit designs for "virtual first" health care.

This trend underscores the potential for key telehealth stakeholders, he said.

The move to include telehealth services within Medicare Advantage's annual bids beginning in 2020 is an important thematic catalyst for Teladoc, Gillmor said.

The pending announcement concerning a contract to serve a large population within UnitedHealth Group Inc (NYSE: UNH), which is in the final stages, could serve as a positive catalyst and would represent an important validation, the analyst said.

The consensus revenue estimate for 2019 assumes 23-percent organic growth — at the low end of Teladoc's 20-30-percent long-term target. With the Street estimates looking conservative, Gillmor said he expects the company to guide 2019 revenue in-line or above consensus.

Notwithstanding the solid gains for the year, the analyst said the stock is 40 percent off its 2018 highs due to the recent market correction and the resignation of Teladoc's CFO/COO. This renders the valuation attractive, he said.

"TDOC remains one of the more compelling growth stories within health care and multiple secular drivers should continue to push adoption/utilization of virtual health solutions in the coming years."

The Price Action

Teladoc shares have jumped about 42 percent in 2018. The stock was up 4.39 percent at $57.84 at the time of publication Monday.

Related Links:

Molina Wins New Bulls On Cost Saving, Margin Opportunities

Morgan Stanley: 4 Reasons To Consider UnitedHealth

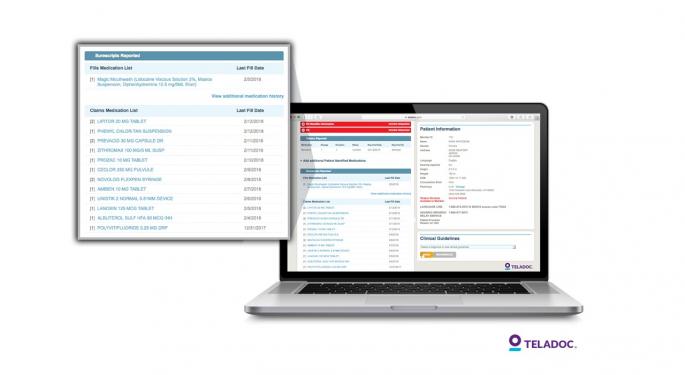

Photo courtesy of Teladoc.

Latest Ratings for TDOC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Piper Sandler | Maintains | Overweight | |

| Mar 2022 | UBS | Maintains | Neutral | |

| Mar 2022 | Argus Research | Upgrades | Hold | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Baird Matthew GillmorAnalyst Color Upgrades Health Care Price Target Analyst Ratings General Best of Benzinga