US Recession Fears Are 'Intensifying' — But Is Bitcoin The Real Flight To Safety? Expert Weighs In

Wall Street's recession sirens are blaring — and as traditional markets brace for impact, Bitcoin's (CRYPTO: BTC) defiant rally has investors asking: is this digital gold 2.0 or just fool's gold with better marketing?

Big Banks Turn Bearish, And Fast

Recession probability forecasts aren't just creeping up — they're sprinting. In the span of days, JPMorgan hiked its odds of a U.S. recession from 40% to 60%, while S&P Global jumped from 25% to 35%. Goldman Sachs and HSBC weren't far behind, now both penciling in a 35%–40% chance.

Related: JPMorgan Raises Recession Risk To 60% As ‘Largest US Tax Hike’ In 60 Years Hits Global Economy

"There can be no doubt that fears of a U.S. recession are intensifying," warned James Toledano, COO of Unity Wallet. "Economic growth is forecast to stall at anywhere between 0.1% and 1%, and many believe these risks are already priced into equities, but I am not so sure that we've even seen the bottom."

For investors looking to tactically position around a recession scenario, the Direxion Daily S&P 500 Bear 3X Shares (NYSE:SPXS) or the Direxion Daily Total Bond Market Bear 1X Shares (NYSE:SAGG) could offer hedges if equities and bonds take a dive. On the flip side, safe-haven sectors like utilities and staples — accessible via the Utilities Select Sector SPDR ETF (NYSE:XLU) or the Consumer Staples Select Sector SPDR Fund (NYSE:XLP) – may see relative outperformance.

Bitcoin Climbs As Uncertainty Grows

Meanwhile, Bitcoin has been showing some real swagger — up over 25% in six months and hovering near $86,000. But it's been reluctant to charge past that level.

"Bitcoin's appeal as a decentralized asset grows, especially as traditional markets face volatility," said Toledano. "While Trump's policies have introduced significant macroeconomic uncertainty, they may paradoxically be fueling Bitcoin's recent rise — though the risks remain elevated for all markets, crypto included."

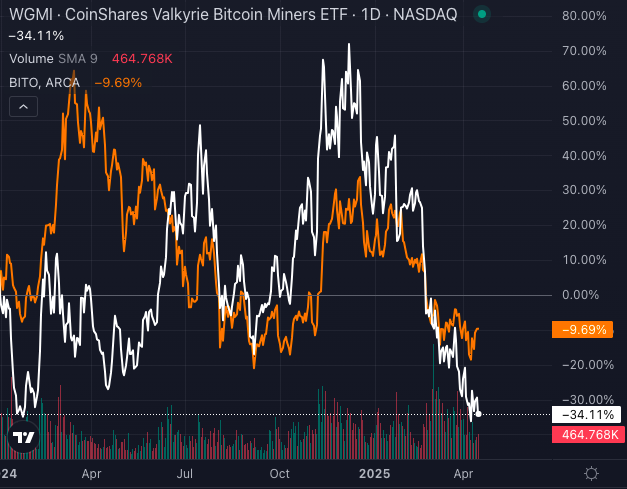

Chart created using Benzinga Pro

Still, if a deep recession hits, will retail investors continue to HODL — or will the thrill give way to fear?

For those betting that crypto's momentum holds, the CoinShares Valkyrie Bitcoin Miners ETF (NYSE:WGMI) or the ProShares Bitcoin Strategy ETF (NYSE:BITO) provide entry points to ride the wave — without having to hold digital wallets.

As recession odds surge and markets wobble, Bitcoin may be the bold bet — but don't forget, volatility cuts both ways.

Read Next:

Photo: Yalcin Sonat via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Cryptocurrency Long Ideas Broad U.S. Equity ETFs Top Stories Markets Analyst Ratings Trading Ideas