Wells Fargo To Rally Around 19%? Here Are 10 Top Analyst Forecasts For Wednesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- UBS raised Dollar General Corporation (NYSE:DG) price target from $120 to $128. UBS analyst Michael Lasser maintained a Buy rating. Dollar General shares closed at $112.62 on Tuesday. See how other analysts view this stock.

- Mizuho boosted the price target for Viper Energy, Inc. (NASDAQ:VNOM) from $54 to $55. Mizuho analyst William Janela maintained an Outperform rating. Viper Energy shares closed at $41.41 on Tuesday. See how other analysts view this stock.

- Goldman Sachs raised XP Inc. (NASDAQ:XP) price target from $17 to $23. Goldman Sachs analyst Tito Labarta upgraded the stock from Neutral to Buy. XP shares closed at $19.33 on Tuesday. See how other analysts view this stock.

- UBS raised the price target for Hewlett Packard Enterprise Company (NYSE:HPE) from $16 to $18. UBS analyst David Vogt maintained a Neutral rating. Hewlett Packard Enterprise shares closed at $17.68 on Tuesday. See how other analysts view this stock.

- RBC Capital increased the price target for Ferguson Enterprises Inc. (NYSE:FERG) from $189 to $231. RBC Capital analyst Mike Dahl maintained an Outperform rating. Ferguson shares closed at $211.53 on Tuesday. See how other analysts view this stock.

- B of A Securities raised Guidewire Software, Inc. (NYSE:GWRE) price target from $135 to $160. B of A Securities analyst Brad Sills maintained an Underperform rating. Guidewire shares settled at $218.13 on Tuesday. See how other analysts view this stock.

- Wells Fargo increased Johnson Controls International plc (NYSE:JCI) price target from $100 to $130. Wells Fargo analyst Joe O’Dea maintained an Overweight rating. Johnson Controls shares closed at $101.18 on Tuesday. See how other analysts view this stock.

- JMP Securities raised HealthEquity, Inc. (NASDAQ:HQY) price target from $110 to $117. JMP Securities analyst Constantine Davides maintained a Market Outperform rating. HealthEquity shares closed at $103.76 on Tuesday. See how other analysts view this stock.

- Wells Fargo increased the price target for Signet Jewelers Limited (NYSE:SIG) from $70 to $75. Wells Fargo analyst Ike Boruchow maintained an Equal-Weight rating. Signet shares settled at $75.24 on Tuesday. See how other analysts view this stock.

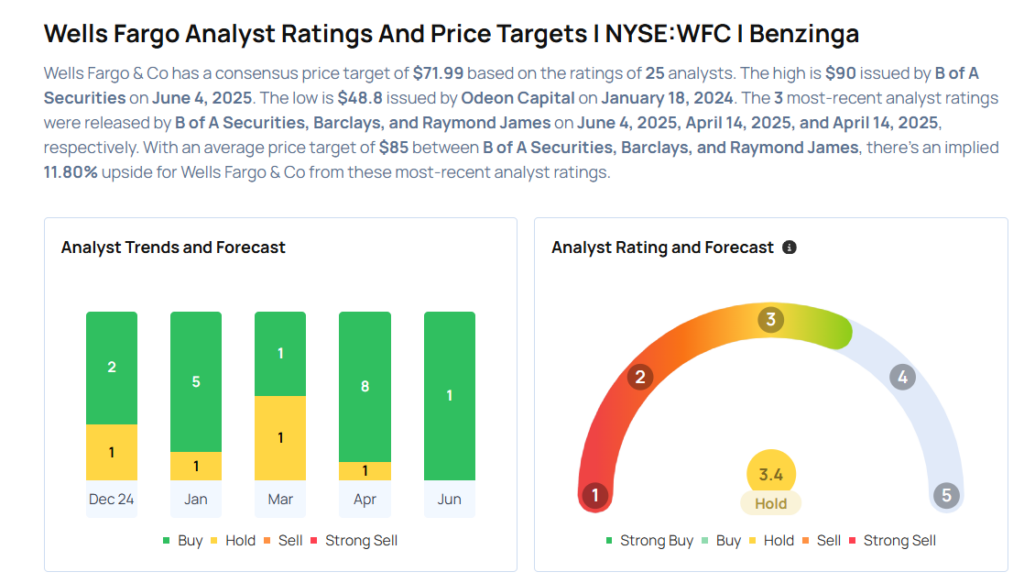

- B of A Securities raised Wells Fargo & Company (NYSE:WFC) price target from $83 to $90. B of A Securities analyst Erika Najarian maintained a Buy rating. Wells Fargo shares closed at $75.65 on Tuesday. See how other analysts view this stock.

Considering buying WFC stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Posted-In: analysts forecasts PT ChangesNews Price Target Markets Analyst Ratings Trading Ideas