These Analysts Boost Their Forecasts On Dana

Dana Incorporated (NYSE:DAN) announced the sale of its Off-Highway business to Allison Transmission for $2.7 billion on Wednesday.

The board authorized a $1 billion capital return program through 2027.

“As we committed to last year, the sale of the Off-Highway business supports our strategy to become a streamlined light- and commercial-vehicle supplier with traditional and electrified systems,” said R. Bruce McDonald, Chairman and Chief Executive Officer of Dana. “This transaction is a critical step in our transformation, meaningfully strengthening our balance sheet, reducing complexity in our business, and allowing us to return significant capital to our shareholders. Combined with our ongoing $300 million cost-savings initiatives, this transaction enables a focused path to grow and innovate, invest in our business, and continue to improve our cost structure.”

Dana shares gained 1.8% to close at $17.71 on Wednesday.

These analysts made changes to their price targets on Dana following earnings announcement.

- Barclays analyst Dan Levy maintained Dana with an Overweight rating and raised the price target from $20 to $25.

- Wells Fargo analyst Colin Langan maintained the stock with an Equal-Weight rating and raised the price target from $15 to $17.

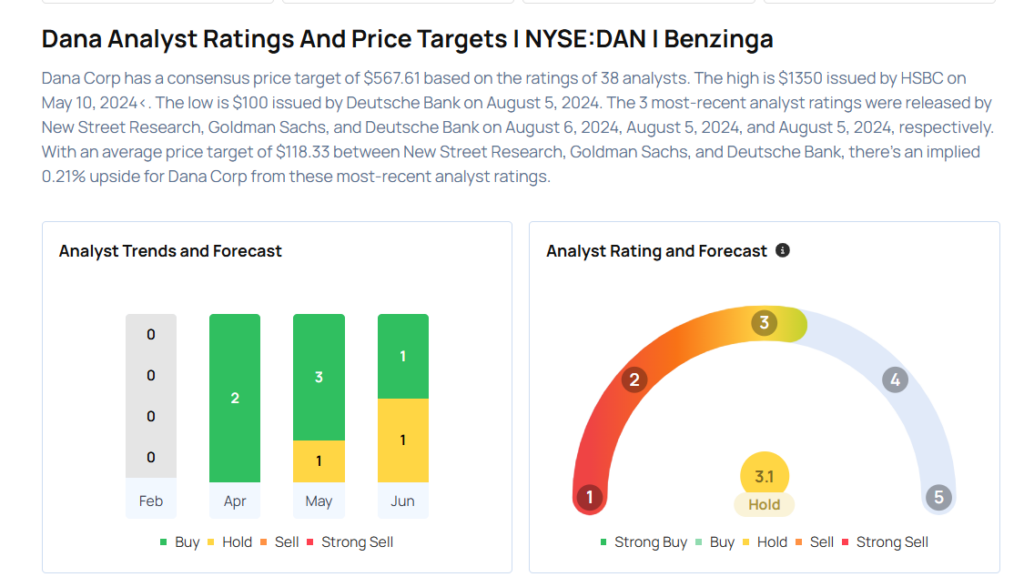

Considering buying DAN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for DAN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | RBC Capital | Maintains | Outperform | |

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Jan 2022 | Barclays | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesNews Price Target Markets Analyst Ratings Trading Ideas