Texas Instruments Likely To Report Higher Q2 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Texas Instruments Incorporated (NASDAQ:TXN) will release earnings results for the second quarter, after the closing bell on Tuesday, July 22.

Analysts expect the Dallas, Texas-based company to report quarterly earnings at $1.33 per share, up from $1.22 per share in the year-ago period. Texas Instruments projects to report quarterly revenue at $4.32 billion, compared to $3.82 billion a year earlier, according to data from Benzinga Pro.

On July 17, the company's board of directors declared a quarterly cash dividend of $1.36 per share of common stock.

Texas Instruments shares fell 1% to close at $214.57 on Monday.

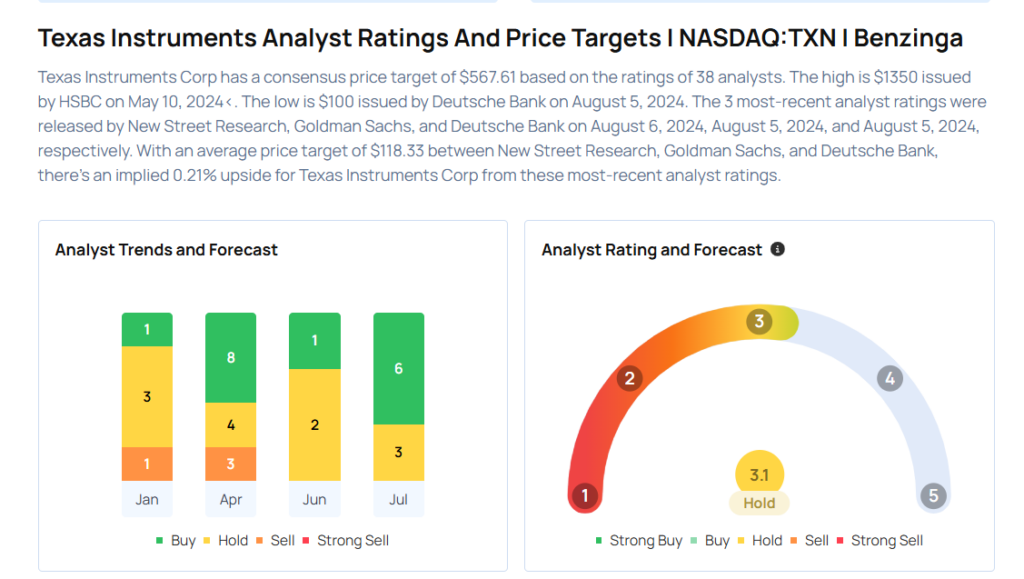

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- UBS analyst Timothy Arcuri maintained a Buy rating and raised the price target from $245 to $255 on July 14, 2025. This analyst has an accuracy rate of 80%.

- Mizuho analyst Vijay Rakesh maintained a Neutral rating and raised the price target from $170 to $205 on July 8, 2025. This analyst has an accuracy rate of 78%.

- Citigroup analyst Christopher Danely maintained a Buy rating and increased the price target from $220 to $260 on July 7, 2025. This analyst has an accuracy rate of 80%.

- Cantor Fitzgerald analyst Matthew Prisco maintained a Neutral rating and raised the price target from $170 to $200 on June 18, 2025. This analyst has an accuracy rate of 72%.

- Morgan Stanley analyst Joseph Moore maintained an Underweight rating and increased the price target from $146 to $148 on April 24, 2025. This analyst has an accuracy rate of 72%.

Considering buying TXN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for TXN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Raymond James | Downgrades | Outperform | Market Perform |

| Feb 2022 | Edward Jones | Downgrades | Buy | Hold |

| Feb 2022 | Barclays | Maintains | Underweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Most Accurate AnalystsEarnings News Price Target Markets Analyst Ratings Trading Ideas