GE Vernova Analysts Increase Their Forecasts After Better-Than-Expected Q2 Earnings

GE Vernova Inc. (NYSE:GEV) posted better-than-expected second-quarter 2025 earnings and raised its full-year guidance on Wednesday.

The energy transition company reported second-quarter earnings per share of $1.86, beating the consensus estimate of $1.69. Revenue came in at $9.11 billion, exceeding Wall Street’s expectations of $8.78 billion.

"We had a productive second quarter, positioning us well to accelerate growth and margin expansion," said CEO Scott Strazik. "We grew our backlog by more than $5 billion and increased Gas Power slot reservation agreements from 50 to 55 gigawatts."

GE Vernova raised its 2025 guidance, expecting revenue to trend toward the higher end of its $36 billion to $37 billion range versus $36.952 billion estimate. The company also lifted its adjusted EBITDA margin forecast to 8% to 9%, up from high-single-digit estimates. It also increased its free cash flow guidance from $3.0 billion to $3.5 billion, from the prior $2.0 billion to $2.5 billion range.

GE Vernova shares fell 1% to trade at $622.50 on Thursday.

These analysts made changes to their price targets on GE Vernova following earnings announcement.

- Baird analyst Ben Kallo maintained GE Vernova with an Outperform rating and raised the price target from $568 to $706.

- Barclays analyst Julian Mitchell maintained the stock with an Overweight rating and raised the price target from $580 to $706.

- Wells Fargo analyst Michael Blum maintained GE Vernova with an Overweight rating and raised the price target from $474 to $697.

- Susquehanna analyst Charles Minervino maintained the stock with a Positive and raised the price target from $662 to $736.

- JP Morgan analyst Mark Strouse maintained GE Vernova with an Overweight rating and raised the price target from $620 to $715.

- Citigroup analyst Andrew Kaplowitz maintained the stock with a Neutral and raised the price target from $544 to $670.

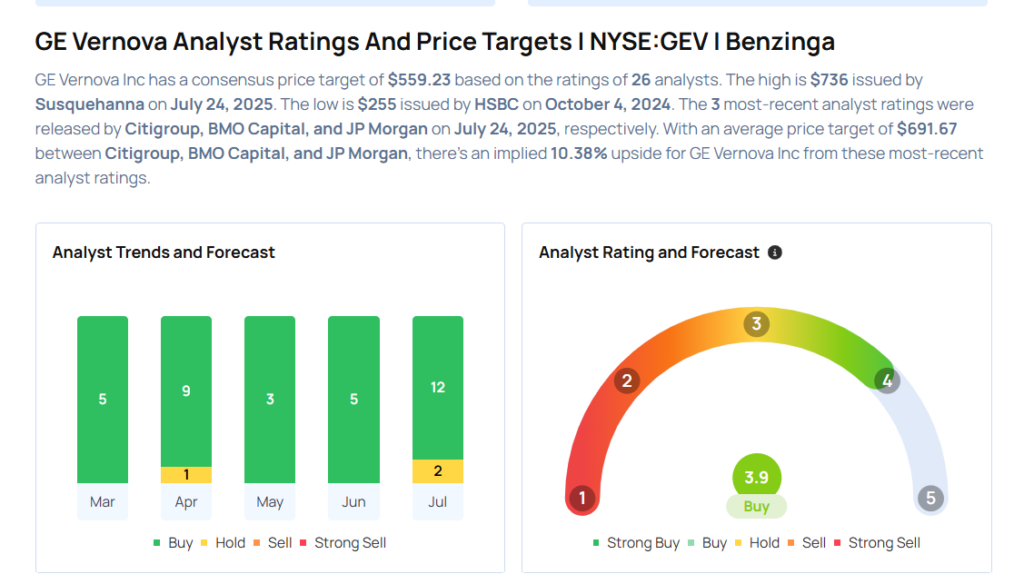

Considering buying GEV stock? Here’s what analysts think:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas