Wayfair Gears Up For Q2 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Wayfair Inc. (NYSE:W) will release earnings results for the second quarter before the opening bell on Monday, Aug. 4.

Analysts expect the Boston, Massachusetts-based company to report quarterly earnings at 33 cents per share, down from 47 cents per share in the year-ago period. Wayfair is projected to report quarterly revenue of $3.12 billion, compared to $3.12 billion a year earlier, according to data from Benzinga Pro.

On May 1, Wayfair reported better-than-expected first-quarter EPS and revenue results.

Wayfair shares fell 0.6% to close at $65.22 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

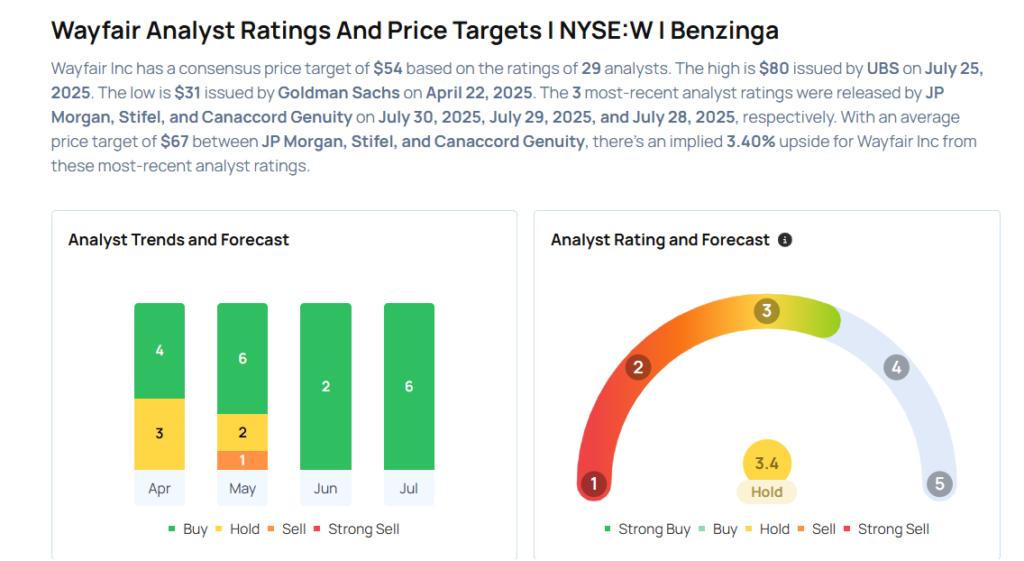

- JP Morgan analyst Christopher Horvers maintained an Overweight rating and raised the price target from $48 to $75 on July 30, 2025. This analyst has an accuracy rate of 72%.

- Stifel analyst Mark Kelley maintained a Hold rating and raised the price target from $32 to $56 on July 29, 2025. This analyst has an accuracy rate of 85%.

- Canaccord Genuity analyst Maria Ripps maintained a Buy rating and boosted the price target from $58 to $70 on July 28, 2025. This analyst has an accuracy rate of 73%.

- UBS analyst Michael Lasser maintained a Buy rating and raised the price target from $55 to $80 on July 25, 2025. This analyst has an accuracy rate of 80%.

- Wells Fargo analyst Zachary Fadem maintained an Overweight rating and increased the price target from $50 to $65 on July 23, 2025. This analyst has an accuracy rate of 84%

Considering buying W stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for W

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Credit Suisse | Maintains | Outperform | |

| Feb 2022 | RBC Capital | Maintains | Sector Perform | |

| Feb 2022 | Needham | Maintains | Buy |

Posted-In: Expert IdeasEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas