JPMorgan's Plan To Impose Fees On Data Aggregators Could 'Cripple' The Crypto Industry, Say Execs: 'This Would Put Everyone Out Of Business'

JPMorgan Chase & Co.‘s (NYSE:JPM) plan to introduce fees for transactions involving cryptocurrencies and third-party services could significantly cripple the fintech industry, say experts.

What Happened: JPMorgan Chase is considering charging data aggregators, such as Plaid and MX, every time a customer transfers funds from their JPMorgan Chase account to a crypto account or a third-party service like Robinhood (NASDAQ:HOOD).

Crypto firms and fintechs commonly use these aggregators to access customer accounts held at major financial institutions such as JPMorgan Chase.

Check out the current price of JPM stock here.

Anonymous industry executives have expressed concerns that this could make it financially unfeasible for many consumers to use stablecoins and crypto. They fear that the fees could “cripple the crypto industry,” reported Fortune.

"This would put everyone out of business…It would require everyone to raise prices by 1000% to cover [the cost]," stated a fintech executive.

Alex Rampell, a general partner at venture firm Andreessen Horowitz, expressed his opinion about JPMorgan’s latest move. "It isn't about a new revenue stream. It's about strangling the competition. And if they get away with this, every bank will follow,” he stated.

Meanwhile, Arjun Sethi, co-CEO of Kraken, one of the largest crypto exchanges in the U.S., described JPMorgan’s plan as a “calculated move” to assert ownership over consumer data. He referred to the plan as a “toll” rather than a technical innovation.

SEE ALSO: Inside Trump’s Oval Office Crypto Push: Why Did 11 Republicans Suddenly Change Their Vote?

Why It Matters: This move by JPMorgan Chase could have significant implications for the fintech industry. Several payments and fintech stocks, including Affirm Holdings Inc. (NASDAQ:AFRM), PayPal Holdings Inc. (NASDAQ:PYPL), and Mastercard Inc. (NYSE:MA), experienced a selloff on Friday after JPMorgan announced its plans to charge significant fees for access to customer bank account data.

This move by JPMorgan could potentially disrupt the fintech industry and make it difficult for smaller players to compete. The impact of these fees on the industry remains to be seen, but this move by JPMorgan could have far-reaching consequences for the fintech and crypto sectors.

JPMorgan Chase’s Q2 report with growth in net interest income and margins highlighted a positive turn in CEO Jamie Dimon‘s comments, indicating resilience in the U.S. economy and financial landscape.

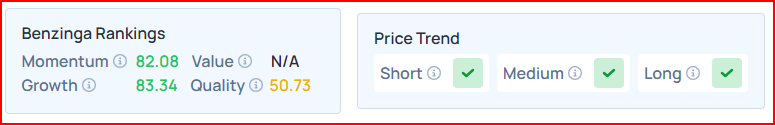

Benzinga's Edge Rankings place JPMorgan in the 83rd percentile for growth and momentum, reflecting its strong performance in both areas. Check the detailed report here.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency