Robinhood CEO Vlad Tenev Defends Tokenizing Elon Musk's SpaceX, Sam Altman's OpenAI: 'They Were A Little Bit Upset…'

Vlad Tenev, the CEO of Robinhood Markets Inc. (NASDAQ:HOOD), is defending his company’s bold move to give retail investors exposure to shares in high-profile private companies such as SpaceX and OpenAI, without seeking their permission.

Check out the current price of HOOD stock here.

What Happened: Speaking on the 20VC podcast on Tuesday, Tenev revealed that Robinhood's new tokenization platform offers access to private market exposure for retail investors through structured instruments, effectively bypassing the need for companies to opt in.

Tenev says, “It's important for the tokenization mechanism to work without the opt-in of the companies that are being tokenized,” and he believes that’s the actual innovation that his company’s been able to drive.

See Also: Jamie Dimon Admits Big Banks Are Behind In The Stablecoin Race

He notes that the initiative has received pushback from a few of the companies involved. “They were a little bit upset by this,” he says, specifically referencing OpenAI, the company behind ChatGPT. Tenev says the company issued a cautionary statement in response to this, which he describes as “a little bit gratuitous.”

Tenev, nonetheless, remains committed to Robinhood’s broader mission of democratizing finance. “Everyone likes tokenization in principle, right? But it's not really as attractive when it's being done to you,” he says.

“Some of the most important companies of our time have not been accessible to retail, and I think that's a huge problem,” Tenev says.

Neither SpaceX nor OpenAI immediately responded to Benzinga’s requests for a comment on this matter. This story will be updated as soon as we hear back.

Why It Matters: According to Matt Hougan, the chief investment officer at Bitwise Asset Management, tokenization represents a 4,000x opportunity, with stocks and bonds alone worth over $257 trillion combined.

BlackRock CEO, Larry Fink, said in his shareholders’ letter recently that “Every stock, every bond, every fund-every asset-can be tokenized,” highlighting the enormity of this market.

Price Action: Shares of Robinhood touched an all-time high last week when the company launched the tokenized versions of 200 publicly listed equities across Europe. On Tuesday, the stock was down 0.42%, trading at $99.54, and is up 0.25% after hours.

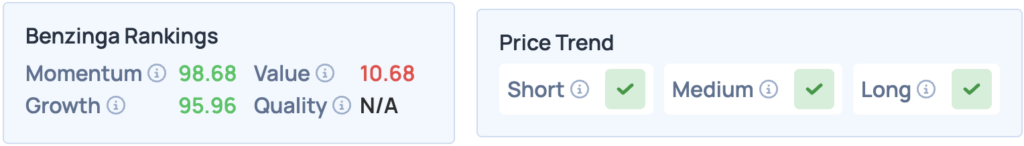

Robinhood scores high on Momentum and Growth in Benzinga’s Edge Stock Rankings, and has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo: Bangla press / Shutterstock.

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency Markets