How Coinbase And Michael Saylor's Strategy Stack Up: Crypto Stock Check-Up Ahead Of Q2 Earnings

Cryptocurrency-focused companies Coinbase Global Inc. (NASDAQ:COIN) and Strategy Inc. (NASDAQ:MSTR), which are due to report their second-quarter earnings after Thursday's market close, have seen their stock performances diverge significantly lately.

What happened: Coinbase, the largest cryptocurrency trading platform in the U.S., recorded a strong price action over the last three months.

The stock peaked at an all-time high of $444.65, driven by the passage of the GENIUS Act, also known as the stablecoin bill, and the progress of the CLARITY Act, two major pieces of cryptocurrency legislation.

See Also: What the Options Market Tells Us About Strategy

The company also reaped the benefits of the cryptocurrency bull run, which drove Bitcoin to an all-time high of $123,000.

Additionally, Coinbase derived momentum from its inclusion in the S&P 500 Index, the widely used benchmark for the U.S. stock market.

While there was a cooldown in July, the stock's gains over the last three months stood at an impressive 81%.

Stocks

3-Month Gains

1-Month Gains

Relative Strength Index

Bull Bear Power Indicator

Moving Average Rating

Overall Technical Rating

Price at Wednesday's market close

Coinbase

+81.08%

+5.08%

54.94 – Neutral

−11.44 – Buy

Buy

Buy

$377.48

Strategy

+0.70%

+1.35%

43.92 – Neutral

−25.99 – Neutral

Sell

Sell

$395.04

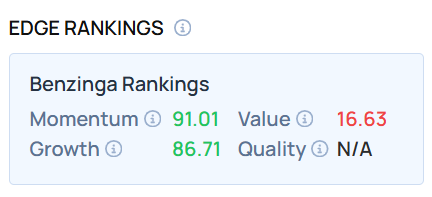

As of this writing, the COIN stock demonstrated a very high Momentum score. Visit Benzinga Edge Stock Rankings to see how MSTR stacks up on this parameter.

Bitcoin treasury company Strategy, meanwhile, lagged in this period, growing by just 0.70%. This was in stark contrast to the 22% gains in Bitcoin.

The performance slightly improved in July as the company executed a $2.52 billion initial public offering of preferred stock and utilized the proceeds to purchase additional BTC.

As of this writing, Strategy held 628,791 BTC, acquired at a total cost of $46.8 billion, averaging $73,227 per Bitcoin across all purchases to date.

Price Action: Shares of Coinbase and Strategy rose around 1.40% in after-hours trading, according to data from Benzinga Pro

Photo Courtesy: insta_photos on Shutterstock.com

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency