Q2 GDP: Choo Choo

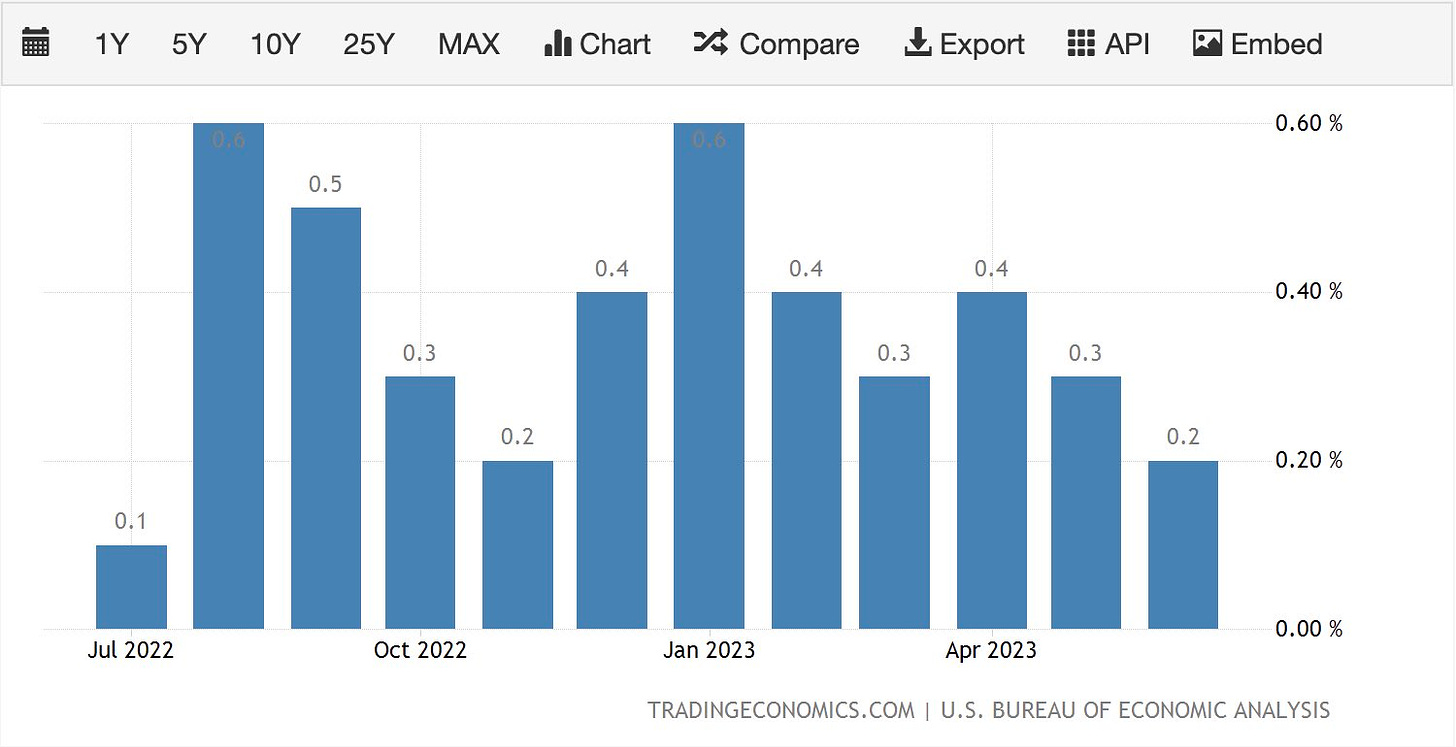

The FED might be winning the war on inflation. Their preferred metric for inflation the PCE Inflation Index surprised below expectations at 4.1%. PCE inflation is now at the lowest reading since 2021. The trend is finally our friend!

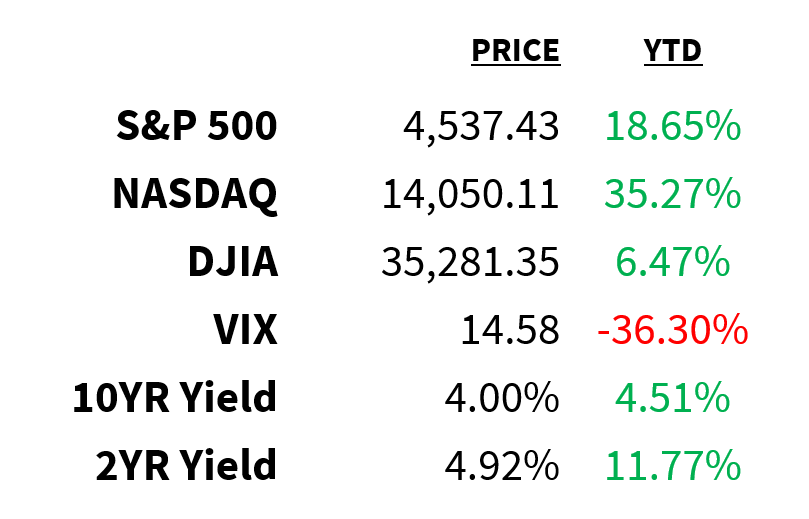

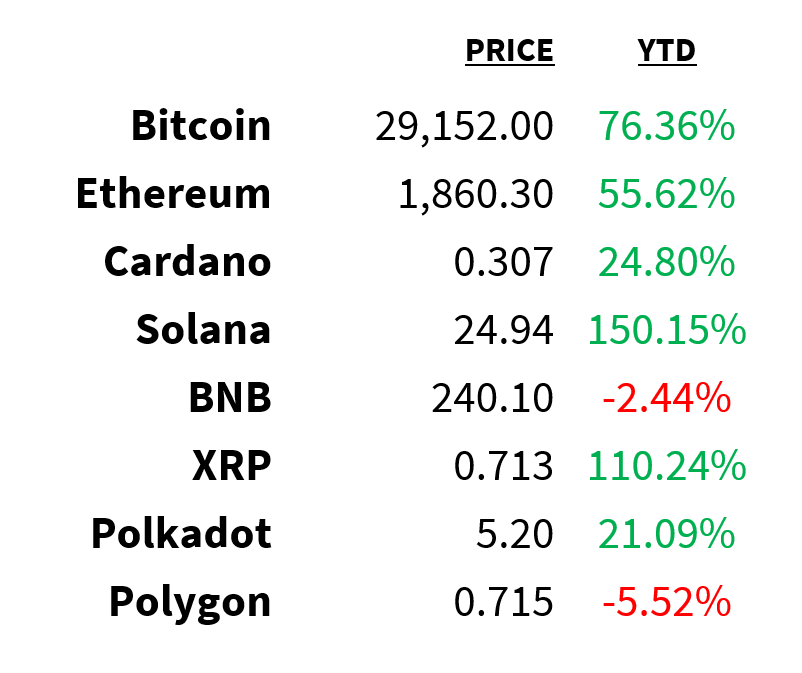

Market

Prices as of 4 pm EST, 7/27/23

Macro

Rainy day funds at America’s biggest banks might be getting bigger.

-

Under new rules proposed by US regulators, banks with over $100 billion in assets would need to raise their capital requirements by ~20%.

-

The bigger the bank, the bigger the requirement.

-

The goal is to mitigate operational risk across activities like lending, trading, and so on.

-

Banks oppose the move, naturally, arguing the measures are extreme and would prove more costly than expected, ultimately hurting consumers.

To quote Fed Chair Powell, the labor market is “very tight”.

-

Last week’s data did nothing to change that with initial jobless claims falling well below expectations to their lowest in 5 months.

-

And workers aren’t staying unemployed for long as continuing claims dropped to the fewest in 6 months.

-

Another sign that demand for labor remains high? Close to 5% of job postings in the US feature a signing bonus

That’s more than 2x the pre-pandemic average of 1.8%, according to Indeed.

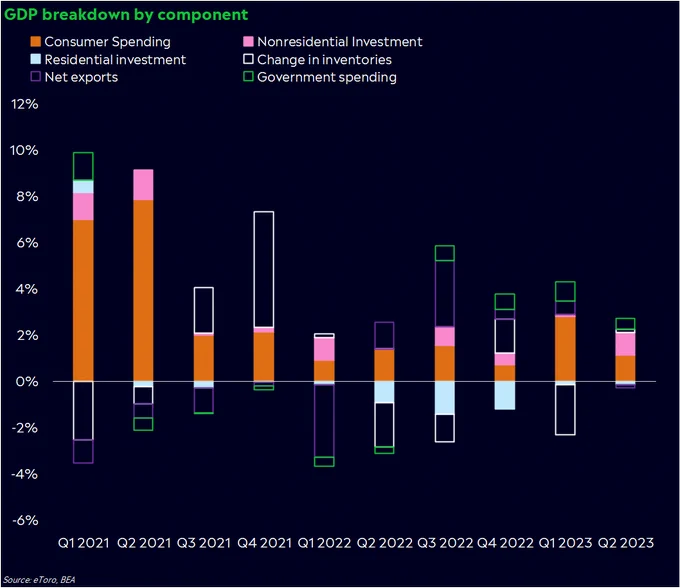

For an economy feared to be on the brink of a recession, the US looks to be full steam ahead.

-

After growing at a 2% pace in the first 3 months of the year, GDP expanded at 2.4% in Q2, crushing expectations of 1.8%.

-

Highlighting the print was the largest growth in business spending in 6 quarters.

-

Personal consumption also outpaced estimates, showing resilience among consumers.

-

Meanwhile, core PCE prices—which the Fed watches closely—fell more than expected to 3.8% (vs. 4% est).

@callieabost

Stocks

Elon Musk has some explaining to do.

-

A new investigative report from Reuters alleges Tesla deployed a secret team to combat thousands of customer complaints.

-

The “Diversion Team” was tasked with and incentivized to cancel as many service appointments as possible.

-

The principal complaint that sparked the special team’s creation?

-

A (much) lower-than-expected driving range.

The Dow ended its winning streak of 13 straight sessions in the green yesterday.

-

It was the longest since 1987.

-

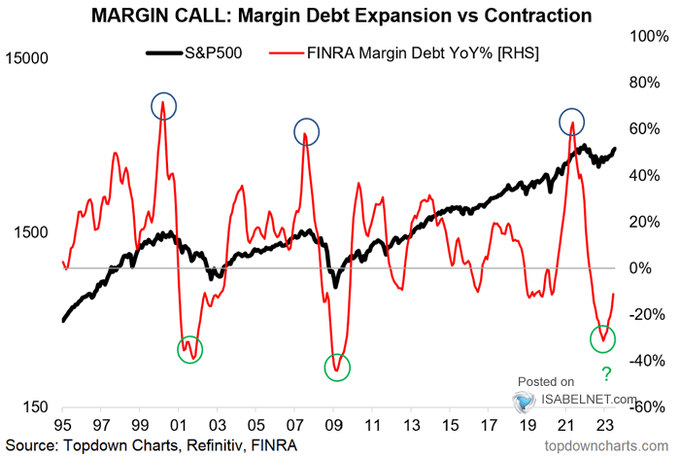

Both retail and institutional investors remain optimistic.

-

According to the AAII Sentiment Survey, the net percentage of bullish retail investors is in the 77th percentile.

-

Turning to the NAAIM Exposure Index, active managers’ exposure to equities ticked up to the highest since November 2021 and is now in the 97th percentile.

-

Separately, a reversal higher in margin debt points to higher risk appetite among investors:

@ISABELNET_SA

Energy

US oil prices are headed for the 5th consecutive weekly gain.

-

The last such win streak for WTI took place from December 2021 to January 2022.

-

Gas prices, meanwhile, are at their highest in 3 months at $3.73 and have been rising steadily since December.

-

Driving higher prices: seasonally low inventories and refinery outages caused by extreme heat.

Earnings

Yesterday’s highlights:

Intel (NASDAQ: INTC): $0.13 EPS (vs. -$0.03 expected), $12.9 billion in sales (vs. $12.13B expected).

-

Revenue fell 15% YoY but the company reversed two straight quarters of losses with a return to profitability.

-

Despite “persistent weakness” across all segments, it guided revenue and profits for the current quarter slightly above analysts’ estimates.

Ford (NASDAQ: FORD): $0.72 EPS (vs. $0.55 expected), $42.43 billion in sales (vs. $40.38B expected).

-

Strong pricing and demand for ICE vehicles offset lower-than-expected EV sales.

-

The company raised its full-year guidance for both earnings and free cash flow.

What we’re watching today:

-

Exxon Mobil (NYSE: XOM)

-

Procter & Gamble (NYSE: PG)

-

Chevron (NYSE: CVX)

-

AstraZeneca (NASDAQ: AZN)

-

Sanofi (NASDAQ: SNY)

-

Rio Tinto (NYSE: RIO)

-

Aon (NYSE: AON)

-

Colgate-Palmolive (NYSE: CL)

-

Charter Communications (NASDAQ: CHTR)

-

Centene (NYSE: CNC)

-

T. Rowe Price (NASDAQ: TROW)

-

Church & Dwight (NYSE: CHD)

-

CNH Industrial (NYSE: CNHI)

-

WP Carey (NYSE: WPC)

-

Booz Allen Hamilton (NYSE: BAH)

-

Franklin Resources (NYSE: BEN)

-

Avantor (NYSE: AVTR)

-

Saia (NASDAQ: SAIA)

Top Headlines

-

Japan shocker: The BOJ surprised markets by loosening its yield cure control.

-

Commodity outlook: The world’s largest miners are increasingly worried about weak commodity prices.

-

Bank buybacks: The Fed’s new rules for lenders mean fewer buybacks for bank stocks.

-

Office space: The amount of office space in the US is declining for the first time…ever.

-

Streaming ads: Netflix is making moves to revive its struggling ad business.

-

Short squeeze: Shares of meme stock Tupperware are up over 340% in the last 5 sessions.

-

SEC warns: Gary Gensler is warning investors over risks in leveraged Treasury trades.

-

PSA: Stocks currently remind Jim Cramer of the 80s and 90s when they were the best asset class.

Crypto

Prices as of 4 pm EST, 7/27/23

-

Binance motion: Binance argues the CFTC doesn’t have jurisdiction over its entities outside the US and is seeking a dismissal of charges.

-

Cybersecurity reporting: The SEC is requiring crypto firms to publish annual reports detailing significant cybersecurity breaches.

-

Downsized: Sequoia Capital more than halved its crypto fund from $585 million to $200 million.

-

Crypto hedgies: CoinShares is pursuing the launch of its first hedge fund open to accredited US investors.

-

Settlement: FTX has reached an agreement in principle with Genesis, its largest creditor with $226 million in claims.

Deals

-

Metals M&A: Brazilian miner Vale will sell a 13% stake in its metals unit for $3.4 billion.

-

Steel M&A: Teck Resources is still mulling offers for its steelmaking business while also fighting off a takeover approach by Glencore.

-

Fast-fashion: Amid rumors of a potential US IPO, Chinese retailer Shein reported record profitability in the first half.

-

High-fashion: Luxury conglomerate Kering will acquire a 30% stake in Valentino for €1.7 billion with an option to buy.

-

EV plans: Chinese EV-maker BYD is considering dropping its $1 billion investment plan to build cars in India.

Meme Of The Day

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: contributors energyMacro Economic Events News Penny Stocks Economics Federal Reserve Markets