Have Gold ETFs Finally Turned?

Gold ETFs have come under fire this year for their persistent weakness and disjointed trading patterns. The combination of a rising U.S. dollar, falling interest rates and tepid inflationary statistics have not been kind to gold bullion prices or associated mining stocks.

More recently, traders have been focused on plunging crude oil and natural gas prices, which has allowed gold the opportunity to make a stealthy move higher. This development may be a signal that a trend change is in the works for the yellow metal.

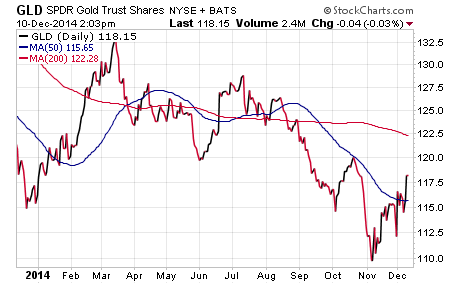

SPDR Gold Trust

Since bottoming in early November, the SPDR Gold Trust (ETF) (NYSE: GLD) has pressed nearly 8 percent higher and regained its 50-day moving average. This well-known precious metals fund is designed to track the daily price fluctuations of gold bullion and has shown marked strength in recent weeks.

Market Vectors Gold Miners

Another corner of the gold market that has seen an even stronger bounce is the Market Vectors Gold Miners ETF (NYSE: GDX). This index tracks 41 large- and mid-cap gold mining stocks from around the globe. GDX currently has $6.4 billion in total assets and charges an expense ratio of 0.53 percent.

After having fallen 40 percent from its 2014 high-water mark, GDX has rebounded 19 percent off the November lows. It too has regained its 50-day moving average and may be mounting a counter-trend rally to regain more of those substantial losses.

Other Possible Factors

Gold has traditionally been a flight to quality instrument during periods of stock volatility and had a noticeable uptick during the October selloff. Further deterioration in equities may generate renewed interest in gold as a hedge instrument.

Another factor that may propel gold buyers is a pullback in the U.S. dollar index. The PowerShares DB US Dollar Index Bullish (NYSE: UUP) has had a powerful five-month winning streak that may be due for a breather. A consolidation or weakness in the dollar may provide a catalyst for global investors to load up on gold bullion or gold mining stocks.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Crude Oil ETF gold bullionSector ETFs Commodities Markets ETFs Best of Benzinga