Trump To Visit Fed – A First For A President In 20 Years; Tough Road Ahead For Tesla

To gain an edge, this is what you need to know today.

Pressure To Cut Rates

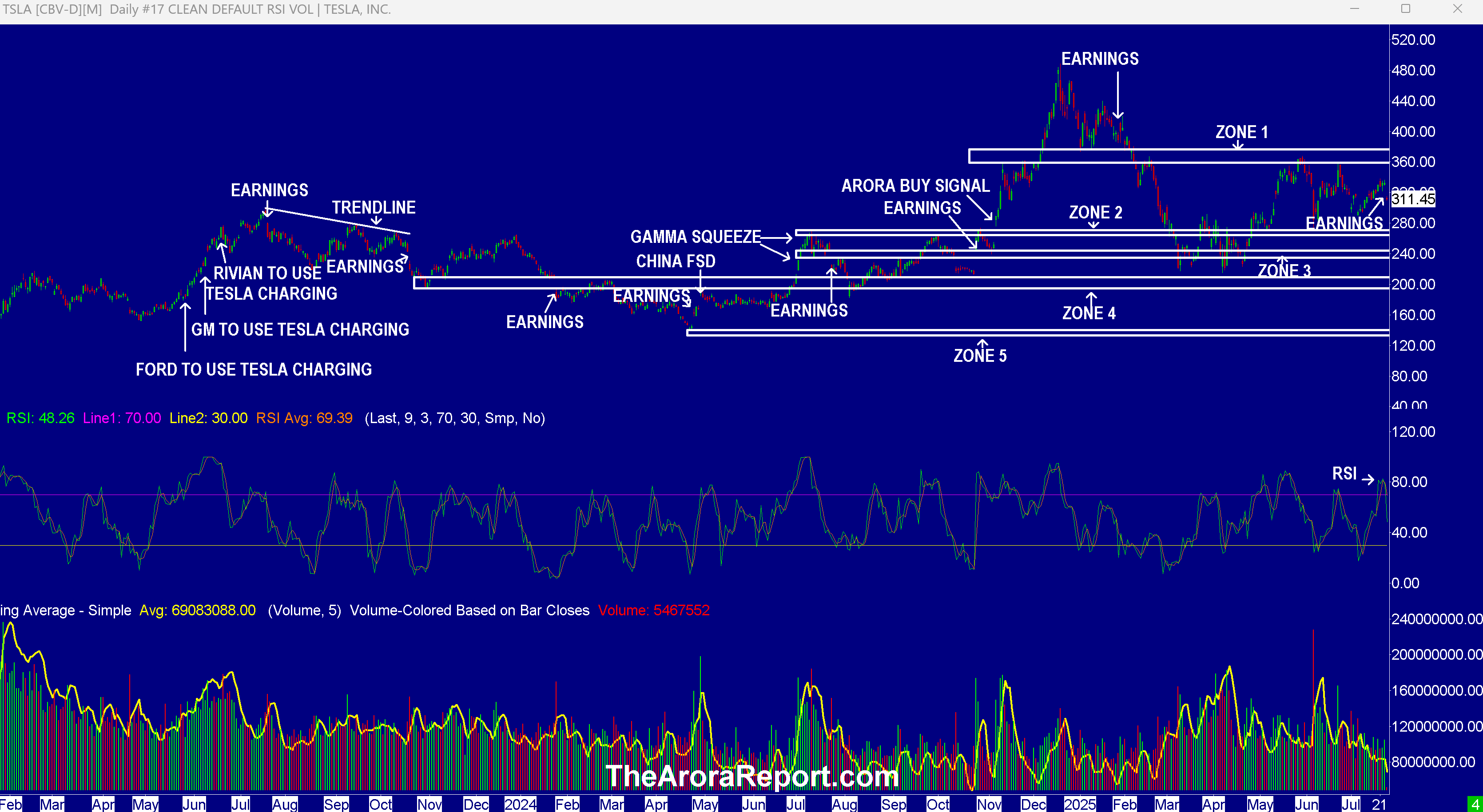

Please click here for an enlarged chart of Tesla Inc (TSLA).

Note the following:

- This article is about the big picture, not an individual stock. The chart of TSLA stock is being used to illustrate the point.

- The chart shows the fall in TSLA stock after reporting earnings.

- The chart shows that zone 2 (support) is far off.

- RSI on the chart shows that TSLA stock is not oversold after the drop.

- On the earnings conference call, Tesla’s CEO Elon Musk shared his ambition of Tesla producing 100K humanoid robots per month in five years. Musk was also positive about the energy side of Tesla. Usually Musk's vision of the future of Tesla creates enough excitement for the stock market to ignore the deteriorating EV side of the business. That is not the case this time. In our analysis, this indicates the momo crowd is moving away from TSLA stock and into more speculative stocks.

- Alphabet‘s earnings were strong. Alphabet raised its capex budget. In our analysis, this is positive for the AI story.

- Prudent investors need to be aware of several crosscurrents in the market today related to interest rates.

- President Trump is planning to visit the Federal Reserve ahead of the FOMC meeting next week. This will be the first time in 20 years a president will visit the Fed. Historically, presidential visits were to endorse the Fed's work and independence. President Trump's visit is expected to have the opposite tone given his threats to fire Fed Chair Powell and demands for the Fed to cut interest rates.

- Treasury Secretary Scott Bessent shared his thoughts on some of the crosscurrents:

- The Fed should cut interest rates one or two times this year.

- China will divest from U.S. Treasuries.

- The Genius Act will increase demand for U.S. Treasuries.

- A one time price increase from tariffs is not inflationary.

- The Treasury auction yesterday was good. Here are the results:

- $13B 20 year Treasury bond reopening

- High yield: 4.935% (When-Issued: 4.951%)

- Bid-to-cover: 2.79

- Indirect bid: 67.4%

- Direct bid: 21.9%

- Initial jobless claims came at 217K vs. 225K consensus. This is very strong data and does not support a rate cut.

- Hopes are high that a trade deal is close between the E.U. and U.S. with 15% tariffs.

- Important earnings after hours today are from Intel Corp (INTC).

- As an actionable item, the sum total of the foregoing is in our Protection Band, which strikes the optimum balance between various crosscurrents.

Japan

There is speculation that Prime Minister Ishiba will resign next month. The Japanese stock market has broken out. Please see yesterday's Morning Capsule. Any political instability may cause the Japanese market to pull back to the Arora buy zone.

India

India and the U.K. have signed a trade deal. Expectations are high that India and the U.S. are also close to a trade deal.

India remains the top investment opportunity among emerging markets for long term investors. As full disclosure, there are three India ETFs in our ZYX Emerging Model Portfolio. They are WisdomTree India Earnings Fund (EPI), iShares MSCI India Small-Cap ETF (SMIN), and VanEck India Growth Leaders ETF (GLIN). As full disclosure, there is also an India focused fund Fairfax India Holdings Corp (FFXDF) in our ZYX Buy Core Model Portfolio. We have a trade around position on FFXDF as well.

Magnificent Seven Money Flows

In the early trade, money flows are positive in NVIDIA Corp (NVDA), Meta Platforms Inc (META), Amazon.com, Inc. (AMZN), and GOOG.

In the early trade, money flows are neutral in Apple Inc (AAPL) and Microsoft Corp (MSFT).

In the early trade, money flows are negative in TSLA.

In the early trade, money flows are neutral in SPDR S&P 500 ETF Trust (SPY) and positive in Invesco QQQ Trust Series 1 (QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (NYSE:GLD). The most popular ETF for silver is iShares Silver Trust (NYSE:SLV). The most popular ETF for oil is United States Oil ETF (ASCA:USO).

Bitcoin

Bitcoin is range bound.

Our Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. Our proprietary Protection Band from puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. Please click here to sign up for a free forever Generate Wealth Newsletter.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasMarket Summary Opinion Markets Trading Ideas