Fox Business Network Anchor David Asman Reflects On Today's Market Free Fall

Fox Business Network anchor David Asman was right in the middle of the action today as U.S. equity markets went into absolute free fall for about 15 minutes Thursday afternoon. At one point, the Dow Jones Industrial Average was down 998.50 points, breaching the 10,000 level. During this unprecedented plunge, which was the largest intra-day decline in history, Asman was manning the FBN news desk, relaying the carnage to awe-struck viewers.

After finishing up his coverage of one of the most volatile and down right frightening days in the markets on record, David was nice enough to answer some questions for Benzinga.com. His answers offer insight and perspective for understandably spooked investors, most of whom are still scratching their heads over today's events and likely fretting about tomorrow.

Q: Right now there is speculation that the incredible selling volume that began at around 2:30 today and took the Dow below 10,000 momentarily was caused by either an erroneous trade in P&G at Citigroup, bad prints, margin calls or program trading triggering a cascading effect. What are you hearing?

A: Clearly there was a glitch in trading that the NYSE is now trying to correct by cancelling trades that were totally whacky between 2:40 and 3 pm. Some fingers were pointed at a huge Procter and Gamble trade (a trade that represented 170 points on the Dow!) made allegedly by Citi. But Citi records show that their P&G trades for the whole day were a lot lower than that one mega trade that started the markets tanking, so they may be off the hook for now. But someone made that trade, and the truth will out!

Q: Do you think that today's events will cause regulators to take a closer look at high frequency trading and program trading?

A: Politicians already have announced that they’re having hearings on what happened today. Congressman Paul E. Kanjorski (PA-11), Chairman of the House Financial Services Subcommittee on Capital Markets, announced that he will hold a hearing on Tuesday, May 11 at 3:00 p.m. to investigate what happened. But honestly…we’ll always have the potential for screw ups like this, and no piece of legislation or regulation will ever make markets fool proof.

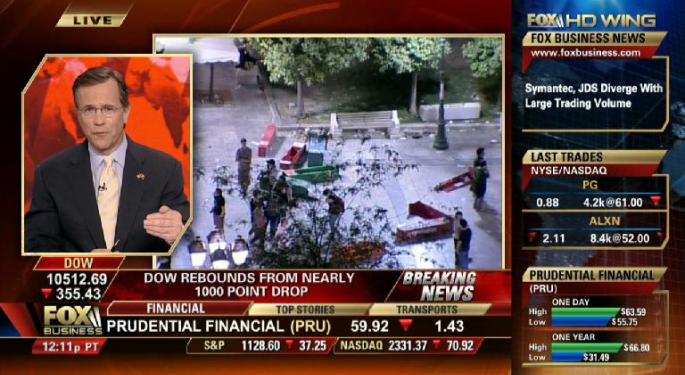

Q: The downside momentum seemed to coincide with the escalation of today's protests in Athens. How much of an effect do you think that those images had on the psyche of the market?

A: The images of the Greek protests absolutely started the slide. Yesterday’s protests turned deadly, and traders were worried that these were about to turn deadly, too. That scared the hell out of folks, thinking that it could spread throughout Europe.

Q: This feels eerily similar to what we saw in the Fall of 2008, except now it is countries that are in the cross-hairs. Do you see any parallels?

A: This may turn out to be a great wake up call for us all…that no government can keep spending beyond its means and “hide the evidence.” Eventually someone has to pay. There’s no such thing as a free lunch. You can’t insure 32 million people for nothing. Economic reality is finally setting in.

Q: Do you have an opinion on what needs to be done in order to guarantee the integrity of our market structure? Today's events suggest that there are structural risks in our markets that could potentially result in disastrous consequences when the system becomes stressed as a result of panic and massive volume and volatility surges.

A: Panic is impossible to eliminate in markets…even when many of those trades are computerized. Remember, computers are programmed by humans, and they’re “taught” to panic and sell off when things pop like they did today.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: David Asman Fox Business NetworkMovers & Shakers Intraday Update Media General