Mark Cuban Examines Trump's Tariff Exemptions Rationale On Electronics: 'That's Billions Of Revenue For The USA'

Billionaire entrepreneur Mark Cuban addressed President Donald Trump‘s tariff exemption strategy on electronics, suggesting it could generate billions in revenue for the United States, while also outlining the potential market shifts it could trigger.

What Happened: Cuban’s comments come amid the Trump administration’s back-and-forth on trade policies and their impact on the tech and manufacturing sectors.

According to Cuban, a potential exemption strategy would allow companies like Apple Inc. (NASDAQ:AAPL) and Dell Technologies Inc. (NYSE:DELL), which manufacture finished products in China, to import their goods into the U.S. market by paying the existing 20% tariff. This, he argues, would generate substantial revenue for the U.S. government.

“I think I see his latest exemption logic. The 20pct still holds. So Let Apple et al bring in finished inventory if they pay the 20pct tariff. Also lets them go full speed in China and bring over as much finished goods inventory as they can. That's billions of revenue for the USA,” he said.

However, Cuban also highlights the potential consequences of such a policy. He points out that if components remain subject to tariffs, companies that import components and assemble or manufacture their products outside of China would be significantly disadvantaged.

This would lead to a potential market share shift, with companies manufacturing finished goods in China gaining a competitive edge.

He also acknowledged the uncertainty surrounding the longevity of such tariffs, emphasizing that this factor could significantly impact long-term business strategies.

Why It Matters: The U.S. Customs and Border Protection exempted smartphones, computers, and semiconductors from reciprocal tariffs late Friday, although a 20% tariff on all Chinese goods remains. The guidance issued late Friday evening comes after Trump earlier this month imposed 145% tariffs on products from China.

However, the Commerce Secretary Howard Lutnick confirmed over the weekend that current tariff exemptions for electronics are only temporary and that additional levies—possibly impacting iPhones—could be introduced within months.

Apple received a temporary tariff exemption on Chinese-made electronics, including iPhones, but analyst Ming-Chi Kuo warned this relief may be short-lived. Its strategy of stockpiling inventory to mitigate trade volatility could lead to supply chain disruptions during model transitions, according to Kuo.

While production lines in China remain idle, highlighting Apple’s intent to shift manufacturing to India, the plan remains subject to change amidst ongoing trade risks like potential semiconductor tariffs.

Price Action: Apple’s stock closed higher by 4.06% on Friday despite an 18.74% decline year-to-date. It was up 14.74% over the year. The exchange-traded fund tracking the Nasdaq 100 index, Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), on the other hand, fell by 10.94% on a YTD basis in 2025.

On Friday, the futures on the S&P 500 index rose by 1.14%, whereas the futures of Dow Jones and the Nasdaq 100 index were up 062% and 1.59%, respectively.

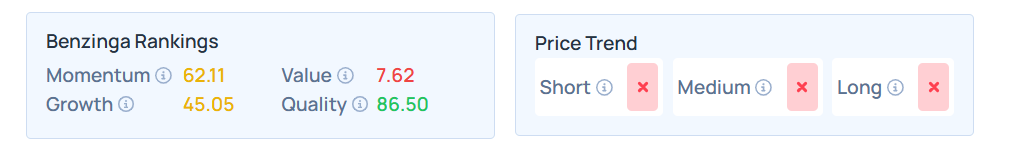

Benzinga Edge Stock Rankings indicate Apple has a negative price trend over the short, medium, and long term. Its momentum ranking was moderate at the 62.11th percentile, and its value ranking was weaker. Further fundamental details about the growth and quality rankings are available here.

Benzinga’s analysis of 29 analysts shows a consensus “buy” rating for the stock, with an average price target of $242.99, ranging from $167.88 to $300. Recent ratings from Jefferies, Keybanc, and Wedbush average $195.96, suggesting a 0.5% potential downside.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: China chips Donald Trump electronics Howard LutnickMarket Summary News Analyst Ratings