Kevin O'Leary Lauds Robinhood's Acquisition Of WonderFi Will 'Transform Cross-Border Trading:' 'No More Outrageous Bank Fees'

After Robinhood Markets Inc. (NASDAQ:HOOD) announced the acquisition of a Canadian cryptocurrency platform, WonderFi Technologies Inc. (OTC:WONDF), renowned entrepreneur and investor Kevin O’Leary expressed his excitement over the deal.

What Happened: O’Leary, who was one of the founding shareholders of WonderFi, said in an X post that he “couldn't be more excited” by this announcement.

According to the company statement, the purchase price of $0.26 per share represents a 41% premium over WonderFi’s closing price on May 12 and a 71% premium over its 30-day volume-weighted average price.

O’Leary stated that this deal is going to transform cross-border trading. “We're finally connecting crypto between Canada and the U.S. right before stablecoin regulations hit. FX trading is about to get a major upgrade,” he said.

He also added that the deal will lead to “No more outrageous bank fees. You'll be able to move money between your Canadian and U.S. accounts instantly and at a fraction of the cost.”

Why It Matters: WonderFi operates Canadian-regulated crypto exchanges Bitbuy and Coinsquare, which hold $1.49 billion in assets under custody.

The deal is anticipated to close in the latter half of 2025 pending approvals, and without any changes in its leadership team.

This acquisition will expand Robinhood’s Canadian crypto presence, adding to its existing Toronto headquarters and workforce of over 140.

The combined equity value of the transaction, on a fully diluted basis, stands at approximately $178 million. Advisors on the deal include J.P. Morgan Securities for Robinhood and Financial Technology Partners for WonderFi.

Price Action: Robinhood shares rose 8.95% on Tuesday, whereas Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), tracking the Nasdaq 100 index, advanced 1.52% during the same session.

The stock has risen 58.65% on a year-to-date basis and 247.23% over a year. WonderFi shares, on the other hand, jumped 35.54% on Tuesday.

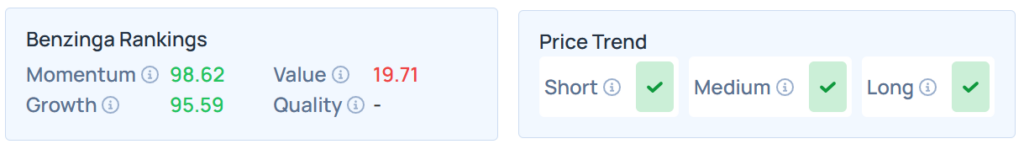

Benzinga Edge Stock Rankings shows that HOOD had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid at 98.62th percentile, whereas its value ranking was poor at 19.71th percentile; the details of other metrics are available here.

Read Next:

Photo Courtesy: Sergei Elagin On Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency Equities Market Summary News Broad U.S. Equity ETFs Futures Markets ETFs