The Risk of Closing a Position That is Working For You

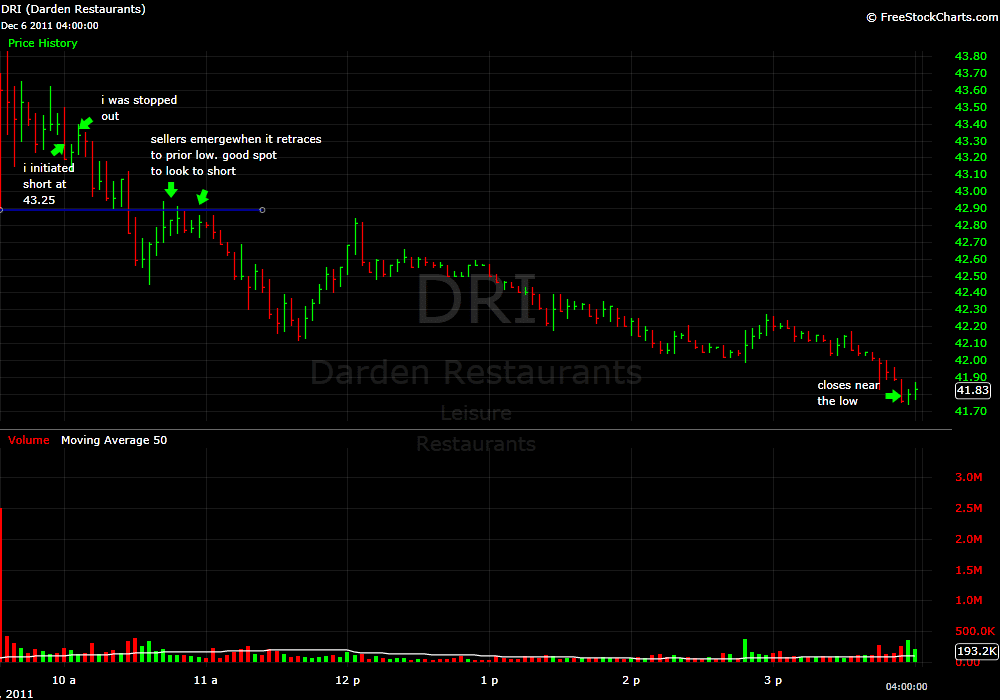

I was watching DRI trade on the Open today. To say that the price action was "whippy" would be an understatement. It seemed to be touching every price and there was no way I could possibly control my risk. So I waited. After 10:00AM I initiated a short position at 43.25. I saw some selling a couple of minutes earlier at 43.50 but when I tried to get short at 43.45 the algos were fighting to get in front of me and I could not get a print. DRI dropped to 43.12 but then quickly spiked up to 43.40 and I was stopped out of my position.

I noticed that two traders on the desk were still short DRI after I had been stopped out. The trade started to work for them. By 10:30 it made a new low knocking out the opening range and pre-market support. It quickly spiked back up to pre-market support, which had become resistance. I asked one of the traders what he was doing with his position and he replied that he had covered and would look to re-short into a spike. Fast forward an hour later and he had never re-entered the position and missed the next point of downside.

One of the strongest psychological urges traders face is exiting positions that are working. This happens for a variety of reasons. If you close a position "while in the money" your ego gets some points for being "right". Another cause of traders closing out positions where they are making money is the inevitable drawdown that occurs when stocks have their natural retracements. And the memories of these drawdowns seem to be much stronger than traders' memories of their positions that continued to trend and work for them. The ability to hold winning positions and managing them in a way that maximizes your upside while adequately controlling risk is an art that can take many years to master. (here is a blog post from 2009 discussing why newbs fail to hold winners http://bit.ly/2BXEXo)

Young traders will frequently ask me how they can learn to hold a profitable position for a longer period of time. The first and easiest step to take is to make sure that you hold a small piece of your position until you know for sure that the position is no longer working. If you have a 400 share short make sure you piece out of the position and hold that last 100 shares until the stock completely reverses its trend or becomes so over extended the risk/reward no longer makes any sense. Notice that by giving young traders two options for closing that final 100 shares I have opened the door for them to wuss out if they so choose.

Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for over 15 years. His email is sspencer@smbcap.com

*live trades discussed in this post took place in T3 Trading Group, LLC a CBSX broker dealer

no current position in DRI

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Darden Restaurants trading psychologyPsychology Topics Markets Trading Ideas Reviews General