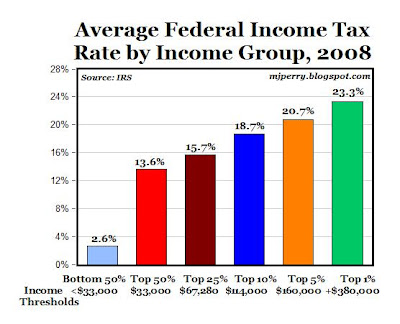

Average Federal Income Tax Rates By Income Group Are Highly Progressive, Not Regressive

My friends and I have been coddled long enough by a billionaire-friendly Congress. It's time for our government to get serious about shared sacrifice."

Dan Mitchell makes several good points today on his blog about the "Oracle of Omaha's" fiscal innumeracy including:

1. Instead of just talking all the time about how he should pay higher taxes, it's time for Warren Buffett to really get serious about "shared sacrifice" by paying higher taxes. He doesn't have to wait for Congress to change tax rates, he can start sending voluntary tax payments right now to the government at the website that Dan provides. If Mr. Buffett thinks that he should pay 36% of his income in federal taxes like the employees in his office, he can make that happen immediately by making a $7.4 million gift to the U.S. Treasury. And he can use his influence to encourage his super-rich friends to do the same.

2. Dan writes that "Buffett mischaracterizes the impact of the Social Security payroll tax, which is dedicated for a specific purpose. The law only imposes that tax on income up to about $107,000 per year because the tax is designed so that people “earn” a corresponding retirement benefit (which actually is tilted in favor of low-income workers)."

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Posted-In: federal tax income groups Warren BuffettTopics General