Charter Communications Likely To Report Higher Q2 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Charter Communications, Inc. (NASDAQ:CHTR) will release earnings results for the second quarter, before the opening bell on Friday, July 25.

Analysts expect the Stamford, Connecticut-based company to report quarterly earnings at $9.78 per share, up from $8.49 per share in the year-ago period. Charter Communications projects to report quarterly revenue at $13.76 billion, compared to $13.69 billion a year earlier, according to data from Benzinga Pro.

On July 22, Charter and Comcast announced an agreement to leverage T-Mobile 5G for wireless business customers.

Charter Communications shares fell 4.6% to close at $380.00 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- UBS analyst John Hodulik maintained a Neutral rating and raised the price target from $400 to $425 on June 18, 2025. This analyst has an accuracy rate of 76%.

- Loop Capital analyst Alan Gould upgraded the stock from Hold to Buy and increased the price target from $430 to $510 on May 19, 2025. This analyst has an accuracy rate of 65%.

- Citigroup analyst Michael Rollins maintained a Buy rating and boosted the price target from $425 to $445 on April 28, 2025. This analyst has an accuracy rate of 76%.

- Wells Fargo analyst Steven Cahall maintained an Equal-Weight rating and raised the price target from $380 to $400 on April 28, 2025. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Benjamin Swinburne maintained an Equal-Weight rating and increased the price target from $385 to $415 on April 28, 2025. This analyst has an accuracy rate of 76%.

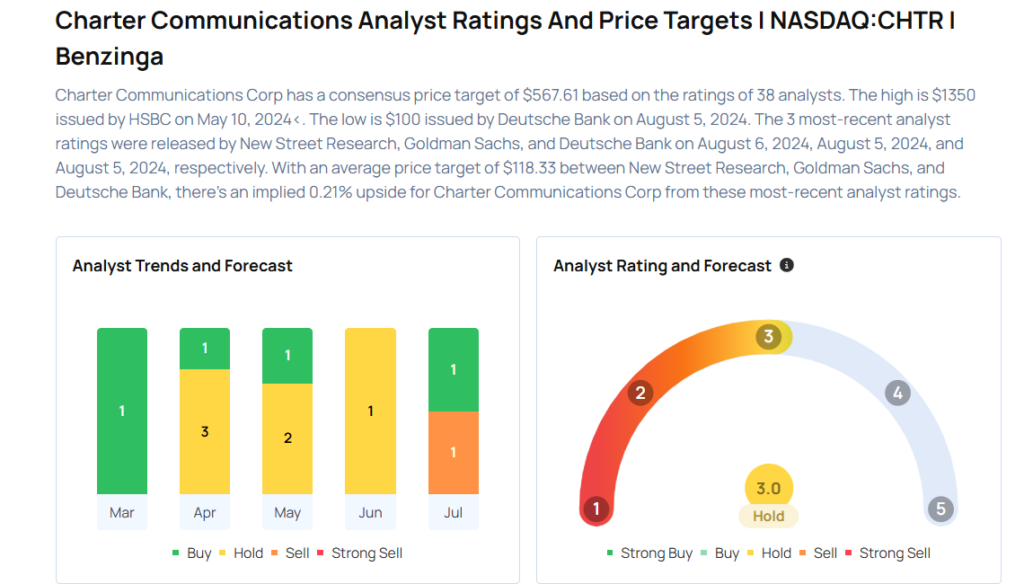

Considering buying CHTR stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for CHTR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Truist Securities | Downgrades | Buy | Hold |

| Jan 2022 | Deutsche Bank | Maintains | Hold | |

| Jan 2022 | Barclays | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert IdeasEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas