What Analysts Are Saying About Mid-America Apartment Stock

Throughout the last three months, 10 analysts have evaluated Mid-America Apartment (NYSE:MAA), offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 3 | 0 | 0 | 0 | 0 |

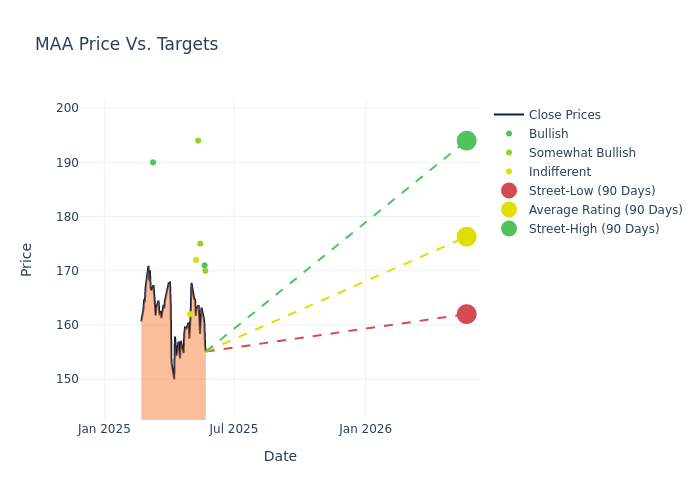

In the assessment of 12-month price targets, analysts unveil insights for Mid-America Apartment, presenting an average target of $175.3, a high estimate of $194.00, and a low estimate of $160.00. This current average reflects an increase of 4.91% from the previous average price target of $167.10.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive Mid-America Apartment is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Aaron Hecht | JMP Securities | Raises | Market Outperform | $170.00 | $160.00 |

| Michael Lewis | Truist Securities | Lowers | Buy | $171.00 | $174.00 |

| Buck Horne | Raymond James | Lowers | Outperform | $175.00 | $185.00 |

| Nicholas Yulico | Scotiabank | Raises | Sector Outperform | $194.00 | $182.00 |

| Richard Hightower | Barclays | Raises | Equal-Weight | $172.00 | $160.00 |

| Wesley Golladay | Baird | Raises | Neutral | $162.00 | $161.00 |

| Richard Hightower | Barclays | Lowers | Equal-Weight | $160.00 | $163.00 |

| Buck Horne | Raymond James | Raises | Strong Buy | $185.00 | $180.00 |

| Michael Lewis | Truist Securities | Raises | Buy | $174.00 | $158.00 |

| Linda Tsai | Jefferies | Raises | Buy | $190.00 | $148.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Mid-America Apartment. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Mid-America Apartment compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Mid-America Apartment's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Mid-America Apartment's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Mid-America Apartment analyst ratings.

Discovering Mid-America Apartment: A Closer Look

Mid-America Apartment Communities Inc or MAA, is a real estate investment trust engaged in the acquisition, operation, and development of multifamily apartment communities located in the southeastern and southwestern United States. The company operates two reportable segments; Same Store includes communities that the Company has owned and have been stabilized for at least a full 12 months as of the first day of the calendar year and Non-Same Store and Other includes recently acquired communities, communities being developed or in lease-up, communities that have been disposed of or identified for disposition, communities that have experienced a casualty loss and stabilized communities that do not meet the requirements to be Same Store communities.

Breaking Down Mid-America Apartment's Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining Mid-America Apartment's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.04% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 32.91%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Mid-America Apartment's ROE stands out, surpassing industry averages. With an impressive ROE of 3.03%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Mid-America Apartment's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.53%, the company showcases efficient use of assets and strong financial health.

Debt Management: Mid-America Apartment's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.84.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MAA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Mizuho | Maintains | Neutral | |

| Nov 2021 | Raymond James | Maintains | Outperform | |

| Oct 2021 | RBC Capital | Maintains | Sector Perform |

Posted-In: BZI-AARAnalyst Ratings