Demystifying Cognex: Insights From 7 Analyst Reviews

Across the recent three months, 7 analysts have shared their insights on Cognex (NASDAQ:CGNX), expressing a variety of opinions spanning from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 3 | 0 | 1 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 2 | 0 | 1 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

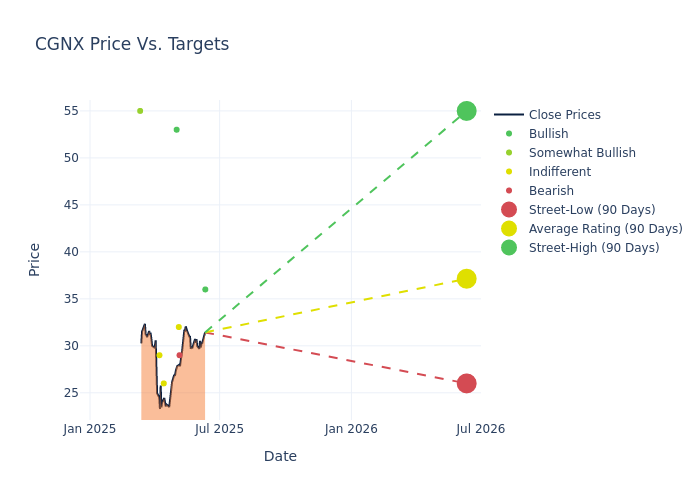

In the assessment of 12-month price targets, analysts unveil insights for Cognex, presenting an average target of $34.0, a high estimate of $53.00, and a low estimate of $26.00. Experiencing a 12.51% decline, the current average is now lower than the previous average price target of $38.86.

Investigating Analyst Ratings: An Elaborate Study

An in-depth analysis of recent analyst actions unveils how financial experts perceive Cognex. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Ricchiuti | Needham | Raises | Buy | $36.00 | $33.00 |

| Joe Ritchie | Goldman Sachs | Lowers | Sell | $29.00 | $33.00 |

| Matthew Summerville | DA Davidson | Lowers | Neutral | $32.00 | $35.00 |

| Damian Karas | UBS | Lowers | Buy | $53.00 | $56.00 |

| James Ricchiuti | Needham | Lowers | Buy | $33.00 | $41.00 |

| Piyush Avasthy | Citigroup | Lowers | Neutral | $26.00 | $37.00 |

| Jamie Cook | Truist Securities | Lowers | Hold | $29.00 | $37.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cognex. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Cognex compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Cognex's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Cognex's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Cognex analyst ratings.

Unveiling the Story Behind Cognex

Cognex Corp provides machine vision products that help automate manufacturing processes. The firm's products include vision software, vision systems, vision sensors, and ID products. Vision software combines vision tools with a customer's cameras and peripheral equipment and can help with several vision tasks, including part location, identification, measurement, and robotic guidance. Vision systems combine a camera, processor, and vision software into a single package. Vision sensors deliver simple, low-cost solutions for common vision applications, such as checking the size of parts. ID products read codes that have been applied to items during the manufacturing process. Cognex generates the maximum proportion of its sales in the United States and Europe.

Cognex: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Cognex's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 2.49%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Cognex's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 10.93%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Cognex's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.59%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Cognex's ROA excels beyond industry benchmarks, reaching 1.2%. This signifies efficient management of assets and strong financial health.

Debt Management: Cognex's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.05.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CGNX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Goldman Sachs | Maintains | Sell | |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | JP Morgan | Upgrades | Underweight | Neutral |

Posted-In: BZI-AARAnalyst Ratings