Dan Ives Sees $1 Trillion Potential In Tesla's AI Ambitions, Calls Elon Musk's EV Giant 'Best Physical AI Play' Alongside Nvidia

Wedbush Securities' investor and Tesla Inc. (NASDAQ:TSLA) bull Dan Ives has reiterated his bullish views on the automaker following its second-quarter earnings call.

Check out the current price of TSLA stock here.

What Happened: Appearing on CNBC's Closing Bell on Wednesday, the investor was bullish on Tesla leading up to the earnings call, hailing Tesla's AI and Robotaxi efforts.

"It's the start of the AI future for Musk and Tesla. It's gonna be worth a trillion dollars alone to the valuation of Tesla," he said in the interview.

The investor then took to social media platform X on Wednesday after the Tesla earnings call. Ives called Elon Musk a "wartime CEO" again in his post, adding that Tesla's autonomous and robotics vision is starting "to take shape."

"Tesla and Nvidia Corp. (NASDAQ:NVDA) remain our 2 best physical AI plays over the next few years," Ives said in the post.

Why It Matters: Ives had earlier set a $500 price target for Tesla in the run-up to the earnings call, as well as maintaining an Outperform rating on the stock. He had also said that the Robotaxi expansion was a "key autonomous initiative for the company."

The comments also follow Tesla's earnings call, which showcased a 12% YoY decline in revenue for Tesla as the automaker reported $22.5 billion in revenue for the second quarter.

Following the update, Future Fund LLC's managing director, Gary Black, slammed Tesla for its affordable Model Y version, which the investor says would not provide the EV giant with any "incremental value" and would not expand its total addressable market.

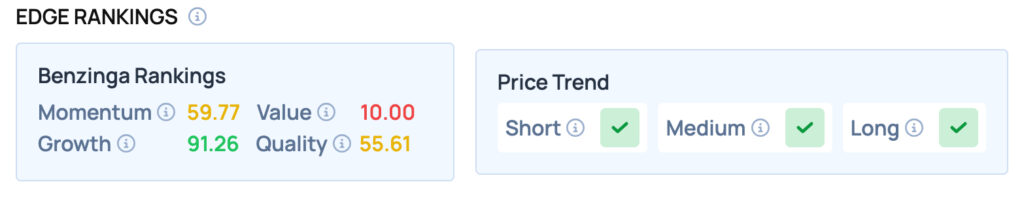

Tesla offers Satisfactory Momentum and Quality, while scoring well on the Growth metric, but offering poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Tech