Breaking Down Illumina: 11 Analysts Share Their Views

Analysts' ratings for Illumina (NASDAQ:ILMN) over the last quarter vary from bullish to bearish, as provided by 11 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 6 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 1 | 0 |

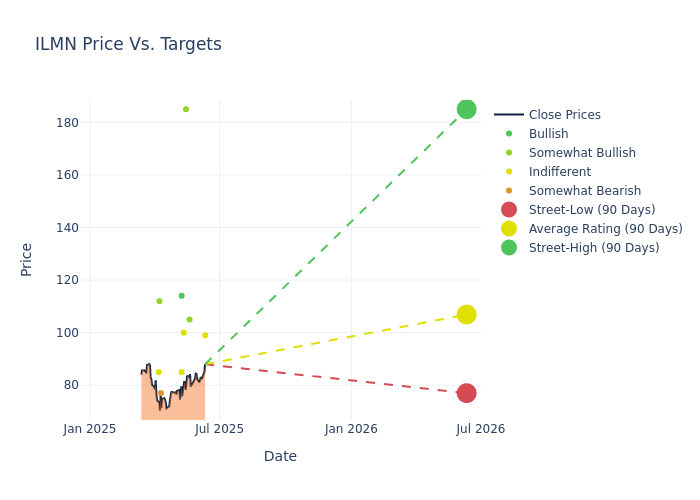

Analysts have recently evaluated Illumina and provided 12-month price targets. The average target is $103.73, accompanied by a high estimate of $185.00 and a low estimate of $77.00. A decline of 11.21% from the prior average price target is evident in the current average.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Illumina among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kyle Mikson | Canaccord Genuity | Raises | Hold | $99.00 | $87.00 |

| Mason Carrico | Stephens & Co. | Maintains | Overweight | $105.00 | $105.00 |

| David Westenberg | Piper Sandler | Lowers | Overweight | $185.00 | $190.00 |

| Tejas Savant | Morgan Stanley | Lowers | Equal-Weight | $100.00 | $136.00 |

| Kyle Mikson | Canaccord Genuity | Lowers | Hold | $87.00 | $92.00 |

| Julia Qin | JP Morgan | Lowers | Neutral | $85.00 | $120.00 |

| Subbu Nambi | Guggenheim | Lowers | Buy | $114.00 | $122.00 |

| Kyle Mikson | Canaccord Genuity | Lowers | Hold | $92.00 | $115.00 |

| Luke Sergott | Barclays | Lowers | Underweight | $77.00 | $100.00 |

| Conor McNamara | RBC Capital | Lowers | Outperform | $112.00 | $128.00 |

| Patrick Donnelly | Citigroup | Lowers | Neutral | $85.00 | $90.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Illumina. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Illumina compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

For valuable insights into Illumina's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Illumina analyst ratings.

Discovering Illumina: A Closer Look

Illumina provides tools and services to analyze genetic material with life science and clinical lab applications. The company generates over 90% of its revenue from sequencing instruments, consumables, and services. Illumina's high-throughput technology enables whole genome sequencing in humans and other large organisms. Its lower throughput tools enable applications that require smaller data outputs, such as viral and cancer tumor screening. Illumina also sells microarrays (9% of 2024 sales) that enable lower-cost, focused genetic screening with primarily consumer and agricultural applications.

Financial Insights: Illumina

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Negative Revenue Trend: Examining Illumina's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -3.25% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Illumina's net margin excels beyond industry benchmarks, reaching 12.58%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Illumina's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.53%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Illumina's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.1% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.1, caution is advised due to increased financial risk.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for ILMN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Feb 2022 | SVB Leerink | Maintains | Market Perform | |

| Jan 2022 | Stifel | Upgrades | Hold | Buy |

Posted-In: BZI-AARAnalyst Ratings