Illumina Stock: What Went Wrong And Why It's Best To Stay Away

Illumina Inc. (NASDAQ:ILMN) is currently in Phase 17 of its 18-phase Adhishthana Cycle on the weekly chart. A detailed structural analysis using the Adhishthana Principles reveals deeper issues that go beyond short-term price action and offers compelling reasons why this stock should be avoided.

Illumina’s Journey So Far

For most of its journey, Illumina followed the Adhishthana Principles closely, both on the weekly and monthly charts. One such strong alignment case took place during Phases 9 to 11, when the stock formed the Adhishthana Himalayan Formation on the weekly chart.

In Phase 9, the stock broke out of its Cakra, which usually signals the beginning of a strong upward move. ILMN rallied by around 73% from its Phase 9 lows, marking the start of the Himalayan ascent. This rally continued into Phase 10, where the stock made its peak, just as expected under the framework.

What followed in Phase 11 was the descent, often referred to in the principles as the Wrath of Ganga. This phase is typically marked by a sharp decline, and ILMN dropped by nearly 67%, retracing all the way back to its Phase 9 breakout levels. This marked the completion of the Himalayan Formation.

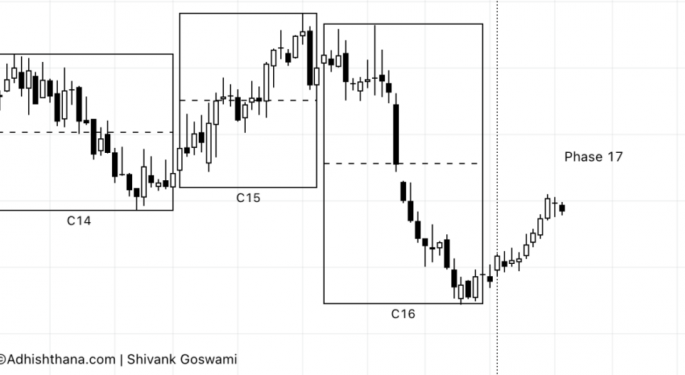

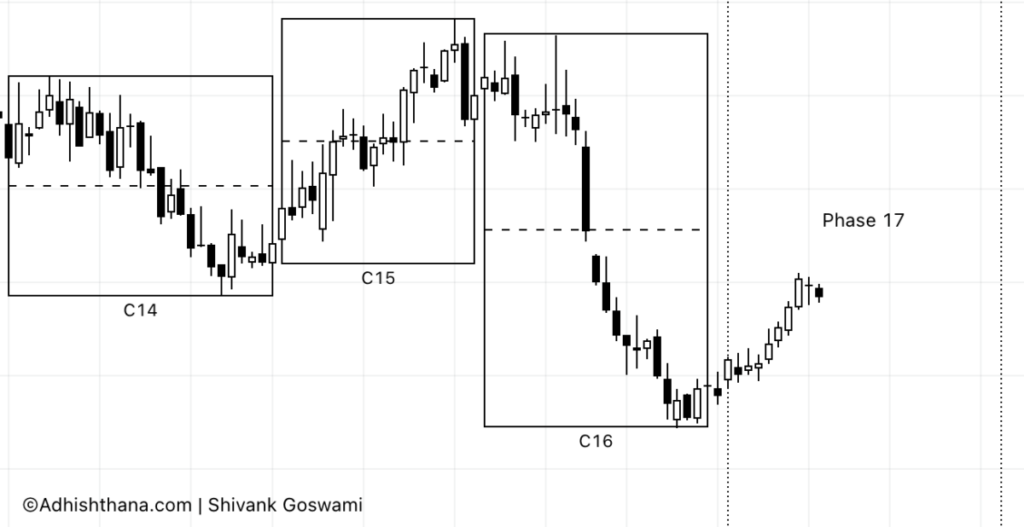

Post Phase 11, the stock failed to show any meaningful signs of recovery and continued to trade with a weak and bearish outlook. It then entered what is known in the Adhishthana framework as the Guna Triads, Phases 14, 15, and 16. These three phases are critical, as they determine whether the stock has the potential to reach Nirvana, the highest point in its cycle, during Phase 18.

In Illumina's case, none of the Guna phases showed Satoguna, which is a clean and decisive bullish move. This lack of strength signals that the stock is unlikely to attain Nirvana in its Phase 18, which runs from 24 November 2025 to 16 May 2027.

While this already points to underperformance on the weekly chart for the next couple of years, a look at the monthly chart reveals even deeper concerns.

Monthly Chart: The Real Concern

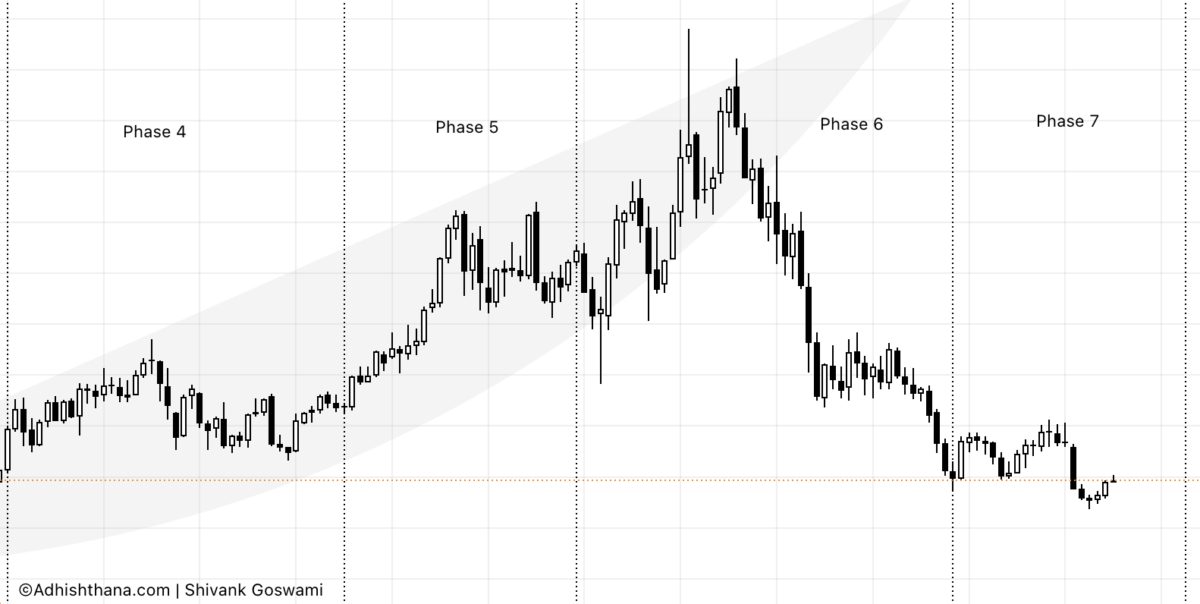

Under the Adhishthana framework, stocks typically form a Cakra structure between Phases 4–8. A breakout from this structure in Phase 9 usually triggers a strong rally. But for Illumina, the opposite occurred.

The stock began building a promising Cakra early in the cycle — until Phase 6, when it broke the Cakra on the flip side, initiating what's known as the Move of Pralayā.

"When the underlying breaks the Cākra on the flip side, it typically draws consolidation up to the Guna triads. The movement after the break is typically highly significant, and the selling momentum is extremely strong. Such a move shall be called the Move of Pralayā." — Adhishthana: The Principles That Govern Wealth, Time & Tragedy

The result? A collapse of over 83%, and a long road ahead. According to the principles, a stock in the Move of Pralayā must be avoided until the end of Phase 13, which for ILMN concludes 18 years from now!!

Investor Outlook

The Move of Pralayā isn’t triggered by ordinary market forces — it reflects deep, structural weakness in the stock fundamentally. While there may be interim rallies, these are unlikely to be sustainable or signal lasting recovery.

- Short-term: With Nirvana ruled out in Phase 18 on the weekly chart, any gains are likely to be fleeting.

- Long-term: The stock is trapped in the aftermath of Pralayā, with more downside and sideways action expected for years.

Conclusion: ILMN should be avoided by long-term investors. Traders may explore advanced, range-bound strategies — but these are suitable only for professionals due to liquidity and skewed option chains.

Curious About the Move of Pralayā?

Read more on how structural breakdowns can shape long-term stock behavior:

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas