Beyond The Numbers: 7 Analysts Discuss Rocket Companies Stock

During the last three months, 7 analysts shared their evaluations of Rocket Companies (NYSE:RKT), revealing diverse outlooks from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 3 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

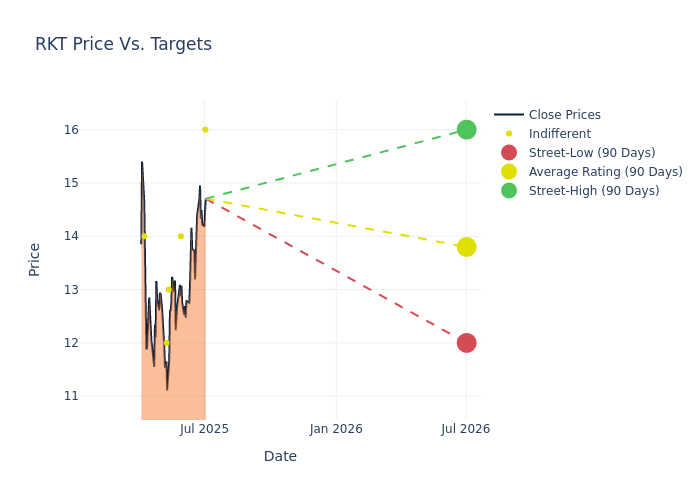

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $13.86, along with a high estimate of $16.00 and a low estimate of $12.00. This upward trend is apparent, with the current average reflecting a 4.29% increase from the previous average price target of $13.29.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Rocket Companies among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ryan Nash | Goldman Sachs | Raises | Neutral | $16.00 | $14.00 |

| Douglas Harter | UBS | Raises | Neutral | $14.00 | $13.00 |

| Bose George | Keefe, Bruyette & Woods | Lowers | Market Perform | $13.00 | $15.00 |

| Jay McCanless | Wedbush | Lowers | Neutral | $12.00 | $13.00 |

| Douglas Harter | UBS | Lowers | Neutral | $13.00 | $14.00 |

| Bose George | Keefe, Bruyette & Woods | Raises | Market Perform | $15.00 | $14.00 |

| Terry Ma | Barclays | Raises | Equal-Weight | $14.00 | $10.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Rocket Companies. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Rocket Companies compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Rocket Companies's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Rocket Companies's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Rocket Companies analyst ratings.

Get to Know Rocket Companies Better

Rocket Companies is a financial services company that was originally founded as Rock Financial in 1985 and is currently based in Detroit. Rocket Companies offers a wide array of services and products but is best known for its Rocket Mortgage business. The company's mortgage lending operations are split between its direct-to-consumer lending, which sees borrowers accessing the company's lending arm directly through either its mobile app or website, and its partner network where mortgage brokers and other firms use Rocket's origination process to offer loans to their customers. The company has rapidly gained market share in recent years and will also be the largest mortgage servicer in the US following its acquisition of the Mr. Cooper Group.

Financial Milestones: Rocket Companies's Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Rocket Companies's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -25.75% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Rocket Companies's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -1.04%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Rocket Companies's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -1.61%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.04%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 9.59.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for RKT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Barclays | Maintains | Equal-Weight | |

| Feb 2022 | Citigroup | Maintains | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Neutral |

Posted-In: BZI-AARAnalyst Ratings