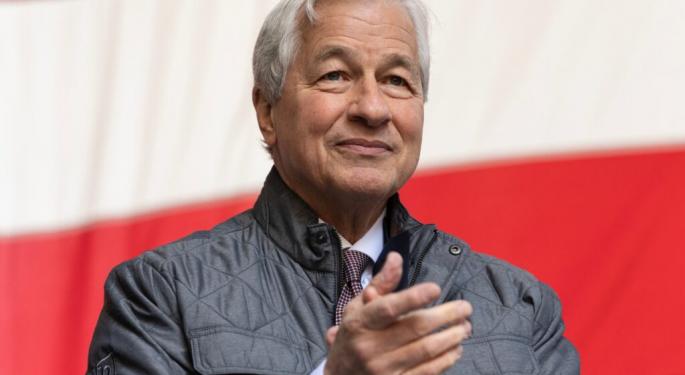

At 14, Jamie Dimon Owned His First Stock, Watched A 45% Market Crash Only To Learn This Investment Lesson: 'History Does Rhyme'

Jamie Dimon, the CEO of JPMorgan Chase & Co. (NYSE:JPM), revealed the pivotal investment lesson he learned as a teenager and how it has shaped his approach to risk management.

What Happened: Dimon, during an interview at New York's Radio City Music Hall on Wednesday, revealed that he bought his first stock at 14 in 1972, witnessed a 45% market nosedive within two years. This experience instilled in him a core lesson to always factor for the invisible risks, stated the CEO.

Check out the current price of JPM stock here.

“All the limousines in Wall Street were gone. Restaurants were being closed. You know, markets move violently,” stated Dimon. He recounted the subsequent market crashes from the 1980s to the dot-com bubble and also the 1929 crash and noticed a common thread, “Too much leverage, too much risk.”

“History Does Rhyme,” stated Dimon.

Dimon’s father, a stockbroker, guided his early foray into the markets. The JPMorgan CEO went on to believe in the philosophy to exercise caution when others are overly enthusiastic about an investment. He emphasizes the importance of stress testing for “the fat tails”—catastrophic events that many believe will never occur.

This early exposure to market volatility taught Dimon the importance of risk management, a principle that has been central to his leadership at JPMorgan Chase. His philosophy has guided him through various financial crises, including the 2008 global financial meltdown.

Dimon focuses on long-term survival rather than chasing short-term profits, even if that means falling behind more aggressive competitors during boom periods.

SEE ALSO: ‘Elon Musk Promised Us Trillions In Cuts. Now, We Are Down To $9 Billion,’ Says Fox News Host

Why It Matters: Dimon’s cautious approach to investment has been evident in his recent warnings about potential market risks. Earlier this month, he raised concerns about the financial markets possibly underestimating the risk of higher U.S. interest rates, a situation he described as a “cause for concern.

These developments, coupled with JPMorgan’s Q2 earnings that exceeded revenue and earnings estimates, suggest that Dimon’s philosophy continues to steer the company towards stability and growth.

Notably, despite his cautious approach, the top banker has also been open to new investment opportunities. In response to Bitcoin’s explosive rally, Dimon was predicted to “go all in on cryptocurrency” by market expert Jim Cramer.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Personal Finance