Breaking Down American Express: 14 Analysts Share Their Views

In the latest quarter, 14 analysts provided ratings for American Express (NYSE:AXP), showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 6 | 0 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 2 | 3 | 0 | 1 |

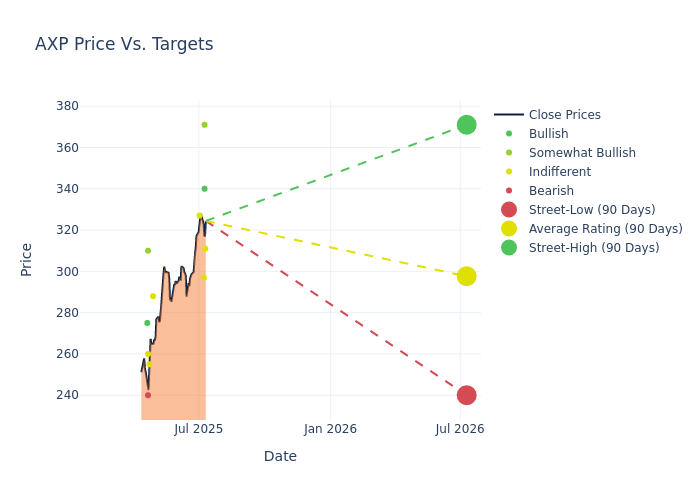

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $302.43, a high estimate of $371.00, and a low estimate of $240.00. This upward trend is evident, with the current average reflecting a 1.56% increase from the previous average price target of $297.79.

Decoding Analyst Ratings: A Detailed Look

The standing of American Express among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Betsy Graseck | Morgan Stanley | Raises | Equal-Weight | $311.00 | $250.00 |

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Raises | Outperform | $371.00 | $360.00 |

| Brian Foran | Truist Securities | Raises | Buy | $340.00 | $335.00 |

| Terry Ma | Barclays | Raises | Equal-Weight | $297.00 | $249.00 |

| Keith Horowitz | Citigroup | Raises | Neutral | $327.00 | $300.00 |

| Brian Foran | Truist Securities | Raises | Buy | $335.00 | $315.00 |

| John Pancari | Evercore ISI Group | Lowers | In-Line | $288.00 | $300.00 |

| Harry Bartlett | Redburn Atlantic | Lowers | Neutral | $255.00 | $270.00 |

| Brian Foran | Truist Securities | Lowers | Buy | $315.00 | $340.00 |

| Ryan Gilbert | BTIG | Lowers | Sell | $240.00 | $272.00 |

| Jon Arfstrom | RBC Capital | Maintains | Outperform | $310.00 | $310.00 |

| Richard Shane | JP Morgan | Raises | Neutral | $260.00 | $244.00 |

| Kenneth Bruce | B of A Securities | Raises | Buy | $275.00 | $274.00 |

| Jon Arfstrom | RBC Capital | Lowers | Outperform | $310.00 | $350.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to American Express. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of American Express compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for American Express's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of American Express's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on American Express analyst ratings.

Delving into American Express's Background

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. The firm operates in four segments: US consumer services, US commercial services, international card services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

American Express: Delving into Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: American Express's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 7.38%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: American Express's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 15.04%, the company may face hurdles in effective cost management.

Return on Equity (ROE): American Express's ROE excels beyond industry benchmarks, reaching 8.3%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): American Express's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.92%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 1.69, American Express adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AXP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Daiwa Capital | Upgrades | Hold | Buy |

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Jan 2022 | Deutsche Bank | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings