What Analysts Are Saying About CDW Stock

Analysts' ratings for CDW (NASDAQ:CDW) over the last quarter vary from bullish to bearish, as provided by 6 analysts.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 4 | 0 | 0 |

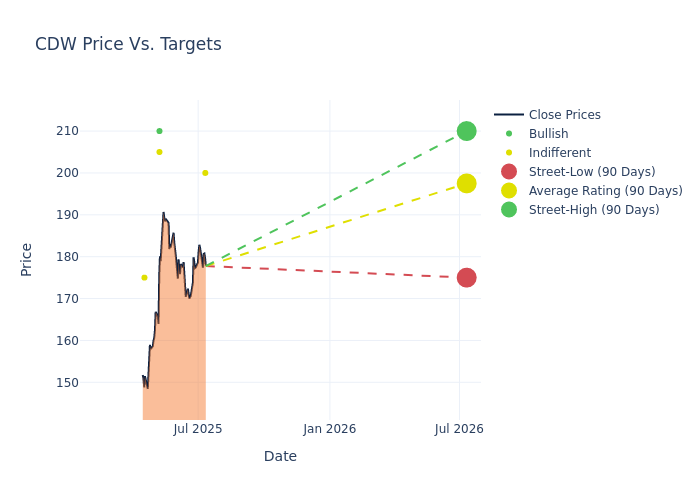

Analysts have set 12-month price targets for CDW, revealing an average target of $188.33, a high estimate of $210.00, and a low estimate of $160.00. This current average represents a 8.94% decrease from the previous average price target of $206.83.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of CDW among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Asiya Merchant | Citigroup | Raises | Neutral | $200.00 | $180.00 |

| Asiya Merchant | Citigroup | Raises | Neutral | $180.00 | $160.00 |

| David Vogt | UBS | Lowers | Buy | $210.00 | $236.00 |

| George Wang | Barclays | Lowers | Equal-Weight | $205.00 | $223.00 |

| Samik Chatterjee | JP Morgan | Lowers | Neutral | $175.00 | $222.00 |

| Asiya Merchant | Citigroup | Lowers | Neutral | $160.00 | $220.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to CDW. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of CDW compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of CDW's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into CDW's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on CDW analyst ratings.

Get to Know CDW Better

CDW Corp is a multi-brand provider of information technology ("IT") solutions to small, medium, and large business, government, education, and healthcare customers in the United States, the United Kingdom, and Canada. The company's broad array of offerings ranges from discrete hardware and software products to integrated IT solutions and services that include on-premise and cloud capabilities across hybrid infrastructure, digital experience, and security. The company has five operating segments namely, Corporate, Small Business, Public, CDW UK, and CDW Canada. The Corporate segment generates the majority of its revenue and serves USA private sector business customers.

CDW: A Financial Overview

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: CDW displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 6.7%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: CDW's net margin excels beyond industry benchmarks, reaching 4.33%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 9.62%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): CDW's ROA excels beyond industry benchmarks, reaching 1.51%. This signifies efficient management of assets and strong financial health.

Debt Management: CDW's debt-to-equity ratio surpasses industry norms, standing at 2.58. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CDW

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Raymond James | Maintains | Outperform | |

| Nov 2021 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings