5 Analysts Have This To Say About Treehouse Foods

In the last three months, 5 analysts have published ratings on Treehouse Foods (NYSE:THS), offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 4 | 0 | 0 |

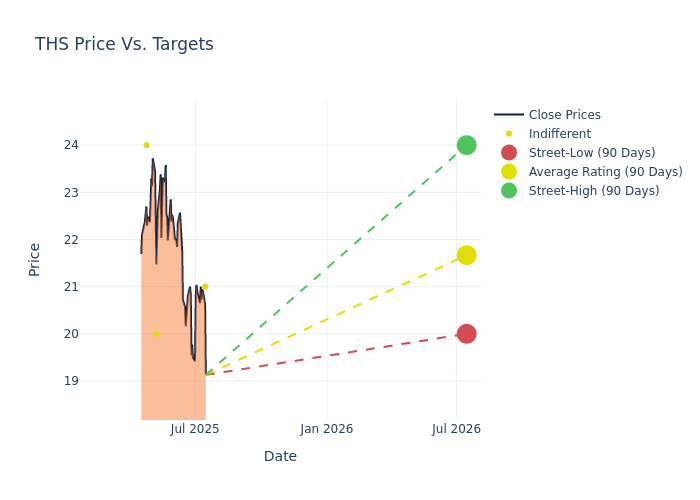

Insights from analysts' 12-month price targets are revealed, presenting an average target of $23.0, a high estimate of $25.00, and a low estimate of $20.00. A decline of 12.88% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Treehouse Foods by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Lazar | Barclays | Lowers | Equal-Weight | $21.00 | $25.00 |

| Andrew Lazar | Barclays | Lowers | Equal-Weight | $25.00 | $26.00 |

| Bill Chappell | Truist Securities | Lowers | Hold | $20.00 | $25.00 |

| Bill Chappell | Truist Securities | Lowers | Hold | $25.00 | $30.00 |

| Matthew Smith | Stifel | Lowers | Hold | $24.00 | $26.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Treehouse Foods. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Treehouse Foods compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Treehouse Foods's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Treehouse Foods's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Treehouse Foods analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Treehouse Foods

TreeHouse Foods is the largest pure-play private-label manufacturer in the US. Much larger in the past following the 2016 acquisition of Ralcorp, Conagra's former private-label business, the company has since divested several businesses to focus on high-growth categories. At present, the company produces and sells snacks (crackers, pretzels, cookies, and so on), beverages and drink mixes (such as nondairy creamer, coffee, tea, broth), and a select number of grocery products (pickles, refrigerated dough, hot cereal, cheese, and pudding). Its most important sales channel is through retail grocery stores that sell its products under their own brands, with co-manufacturing and food away from home as much smaller channels of distribution for its fare.

Breaking Down Treehouse Foods's Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Treehouse Foods's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -3.5% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Treehouse Foods's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -4.02%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Treehouse Foods's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -2.07%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Treehouse Foods's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.8%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Treehouse Foods's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.04.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for THS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Aug 2021 | Credit Suisse | Maintains | Neutral | |

| Feb 2021 | Truist Securities | Downgrades | Buy | Hold |

| Feb 2021 | Credit Suisse | Downgrades | Outperform | Neutral |

Posted-In: BZI-AARAnalyst Ratings