Deep Dive Into Vertiv Holdings Stock: Analyst Perspectives (9 Ratings)

In the last three months, 9 analysts have published ratings on Vertiv Holdings (NYSE:VRT), offering a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 3 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

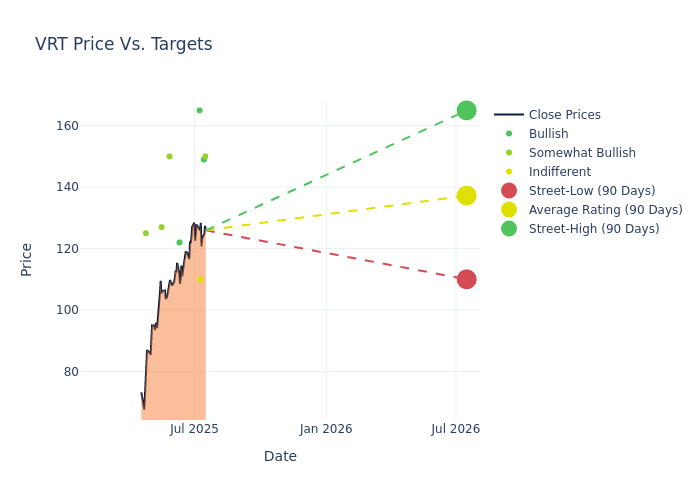

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $136.44, a high estimate of $165.00, and a low estimate of $110.00. This upward trend is evident, with the current average reflecting a 20.03% increase from the previous average price target of $113.67.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive Vertiv Holdings is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brett Linzey | Mizuho | Raises | Outperform | $150.00 | $125.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $149.00 | $130.00 |

| Julian Mitchell | Barclays | Raises | Equal-Weight | $110.00 | $90.00 |

| Scott Davis | Melius Research | Raises | Buy | $165.00 | $134.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $130.00 | $98.00 |

| Mark Delaney | Goldman Sachs | Raises | Buy | $122.00 | $106.00 |

| Amit Daryanani | Evercore ISI Group | Raises | Outperform | $150.00 | $100.00 |

| Stephen Tusa | JP Morgan | Raises | Overweight | $127.00 | $100.00 |

| Chris Snyder | Morgan Stanley | Lowers | Overweight | $125.00 | $140.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Vertiv Holdings. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Vertiv Holdings compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Vertiv Holdings's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Vertiv Holdings's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Vertiv Holdings analyst ratings.

Get to Know Vertiv Holdings Better

Vertiv has roots tracing back to 1946 when its founder, Ralph Liebert, developed an air-cooling system for mainframe data rooms. As computers started making their way into commercial applications in 1965, Liebert developed one of the first computer room air conditioning, or CRAC, units, enabling the precise control of temperature and humidity. The firm has slowly expanded its data center portfolio through internal product development and the acquisition of thermal and power management products like condensers, busways, and switches. Vertiv has global operations today; its products can be found in data centers in most regions throughout the world.

Key Indicators: Vertiv Holdings's Financial Health

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Vertiv Holdings displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 24.21%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Vertiv Holdings's net margin excels beyond industry benchmarks, reaching 8.08%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Vertiv Holdings's ROE stands out, surpassing industry averages. With an impressive ROE of 6.45%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Vertiv Holdings's ROA stands out, surpassing industry averages. With an impressive ROA of 1.77%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Vertiv Holdings's debt-to-equity ratio stands notably higher than the industry average, reaching 1.18. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for VRT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Mizuho | Maintains | Neutral | |

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | Cowen & Co. | Downgrades | Outperform | Market Perform |

Posted-In: BZI-AARAnalyst Ratings