13 Analysts Have This To Say About Hewlett Packard

Across the recent three months, 13 analysts have shared their insights on Hewlett Packard (NYSE:HPE), expressing a variety of opinions spanning from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 5 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 2 | 1 | 0 | 0 |

| 2M Ago | 1 | 2 | 4 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

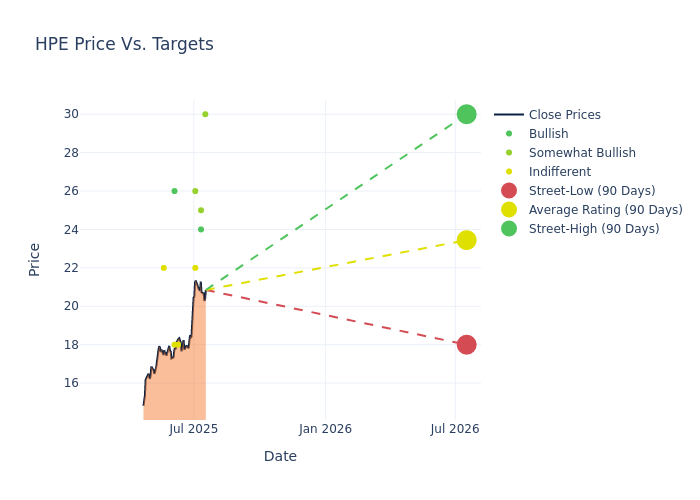

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $23.08, along with a high estimate of $30.00 and a low estimate of $18.00. This current average reflects an increase of 19.4% from the previous average price target of $19.33.

Decoding Analyst Ratings: A Detailed Look

The perception of Hewlett Packard by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Samik Chatterjee | JP Morgan | Announces | Overweight | $30.00 | - |

| Amit Daryanani | Evercore ISI Group | Raises | Outperform | $25.00 | $22.00 |

| Wamsi Mohan | B of A Securities | Raises | Buy | $24.00 | $23.00 |

| Aaron Rakers | Wells Fargo | Raises | Equal-Weight | $22.00 | $20.00 |

| Tim Long | Barclays | Raises | Overweight | $26.00 | $24.00 |

| Wamsi Mohan | B of A Securities | Raises | Buy | $23.00 | $20.00 |

| Ananda Baruah | Loop Capital | Raises | Hold | $18.00 | $16.00 |

| Simon Leopold | Raymond James | Raises | Strong Buy | $26.00 | $23.00 |

| David Vogt | UBS | Raises | Neutral | $18.00 | $16.00 |

| Aaron Rakers | Wells Fargo | Raises | Equal-Weight | $20.00 | $17.00 |

| Tim Long | Barclays | Raises | Overweight | $24.00 | $20.00 |

| Meta Marshall | Morgan Stanley | Raises | Equal-Weight | $22.00 | $14.00 |

| Amit Daryanani | Evercore ISI Group | Raises | Outperform | $22.00 | $17.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Hewlett Packard. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Hewlett Packard compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Hewlett Packard's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Hewlett Packard's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Hewlett Packard analyst ratings.

Unveiling the Story Behind Hewlett Packard

Hewlett Packard Enterprise is an information technology vendor that provides hardware and software to enterprises. Its primary product lines are compute servers, storage arrays, and networking equipment; it also has a high-performance computing business. HPE's stated goal is to be a complete edge-to-cloud company. Its portfolio enables hybrid clouds and hyperconverged infrastructure. It uses a primarily outsourced manufacturing model and employs 60,000 people worldwide.

Key Indicators: Hewlett Packard's Financial Health

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Hewlett Packard displayed positive results in 3M. As of 30 April, 2025, the company achieved a solid revenue growth rate of approximately 5.87%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -14.15%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -4.4%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Hewlett Packard's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -1.56%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Hewlett Packard's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.73.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for HPE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Bernstein | Upgrades | Market Perform | Outperform |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Jan 2022 | Barclays | Upgrades | Equal-Weight | Overweight |

Posted-In: BZI-AARAnalyst Ratings