Demystifying Taiwan Semiconductor: Insights From 6 Analyst Reviews

Taiwan Semiconductor (NYSE:TSM) has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

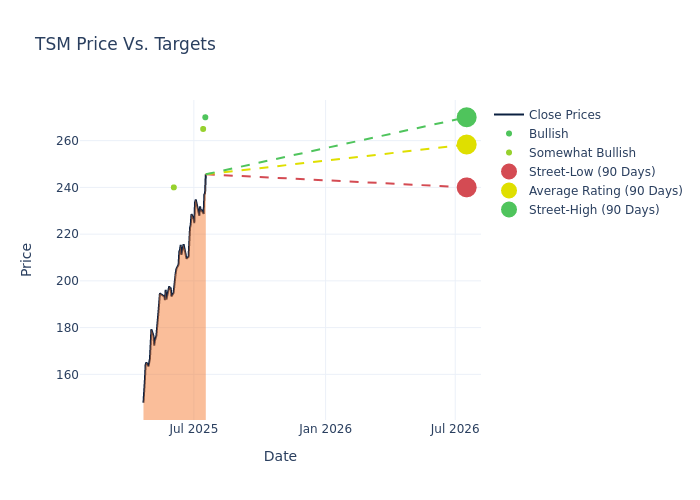

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $252.5, with a high estimate of $270.00 and a low estimate of $215.00. This current average reflects an increase of 3.06% from the previous average price target of $245.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Taiwan Semiconductor's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Charles Shi | Needham | Maintains | Buy | $270.00 | $270.00 |

| Mehdi Hosseini | Susquehanna | Raises | Positive | $265.00 | $255.00 |

| Charles Shi | Needham | Raises | Buy | $270.00 | $225.00 |

| Mehdi Hosseini | Susquehanna | Raises | Positive | $255.00 | $250.00 |

| Simon Coles | Barclays | Raises | Overweight | $240.00 | $215.00 |

| Simon Coles | Barclays | Lowers | Overweight | $215.00 | $255.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Taiwan Semiconductor. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Taiwan Semiconductor compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Taiwan Semiconductor's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Taiwan Semiconductor's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Taiwan Semiconductor analyst ratings.

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with mid-60s market share in 2024. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public in Taiwan in 1994 and as an ADR in the US in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Breaking Down Taiwan Semiconductor's Financial Performance

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Taiwan Semiconductor's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 41.61%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Taiwan Semiconductor's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 42.98%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Taiwan Semiconductor's ROE excels beyond industry benchmarks, reaching 8.19%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Taiwan Semiconductor's ROA stands out, surpassing industry averages. With an impressive ROA of 5.22%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Taiwan Semiconductor's debt-to-equity ratio is below the industry average at 0.22, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TSM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Atlantic Equities | Upgrades | Neutral | Overweight |

| Oct 2021 | Cowen & Co. | Initiates Coverage On | Market Perform | |

| Jul 2021 | Needham | Initiates Coverage On | Buy |

Posted-In: BZI-AARAnalyst Ratings