22 Analysts Assess Carvana: What You Need To Know

In the latest quarter, 22 analysts provided ratings for Carvana (NYSE:CVNA), showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 10 | 6 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 1 | 0 | 0 |

| 3M Ago | 4 | 6 | 3 | 0 | 0 |

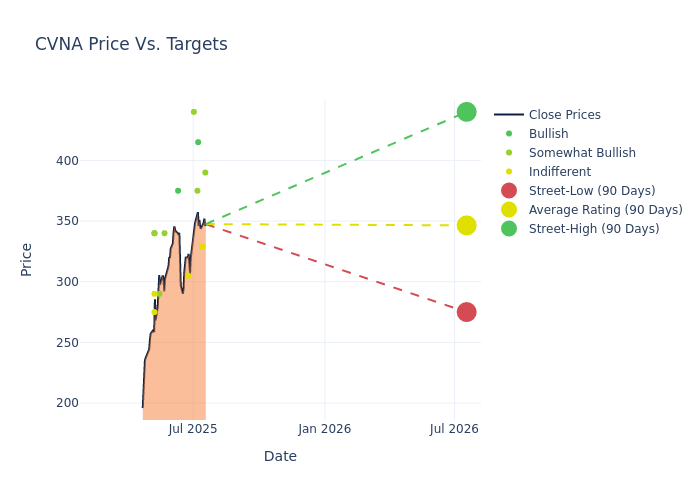

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $325.86, along with a high estimate of $440.00 and a low estimate of $230.00. Marking an increase of 14.05%, the current average surpasses the previous average price target of $285.71.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Carvana among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Lantz | Wells Fargo | Raises | Overweight | $390.00 | $310.00 |

| Robert Mollins | Gordon Haskett | Announces | Hold | $329.00 | - |

| Ronald Josey | Citigroup | Raises | Buy | $415.00 | $325.00 |

| Jeff Lick | Stephens & Co. | Raises | Overweight | $375.00 | $300.00 |

| Nicholas Jones | JMP Securities | Raises | Market Outperform | $440.00 | $275.00 |

| Michael Montani | Evercore ISI Group | Raises | In-Line | $305.00 | $295.00 |

| Michael Montani | Evercore ISI Group | Raises | In-Line | $295.00 | $290.00 |

| Michael McGovern | B of A Securities | Raises | Buy | $375.00 | $325.00 |

| Alexander Potter | Piper Sandler | Raises | Overweight | $340.00 | $315.00 |

| Adam Jonas | Morgan Stanley | Raises | Overweight | $290.00 | $280.00 |

| Michael McGovern | B of A Securities | Raises | Buy | $325.00 | $295.00 |

| Michael Montani | Evercore ISI Group | Raises | In-Line | $280.00 | $245.00 |

| Seth Basham | Wedbush | Raises | Neutral | $290.00 | $260.00 |

| Ronald Josey | Citigroup | Raises | Buy | $325.00 | $280.00 |

| Michael McGovern | B of A Securities | Raises | Buy | $295.00 | $290.00 |

| Brad Erickson | RBC Capital | Raises | Outperform | $340.00 | $320.00 |

| Alexander Potter | Piper Sandler | Raises | Overweight | $315.00 | $230.00 |

| David Lantz | Wells Fargo | Raises | Overweight | $310.00 | $290.00 |

| Colin Sebastian | Baird | Raises | Neutral | $275.00 | $200.00 |

| Chris Pierce | Needham | Maintains | Buy | $340.00 | $340.00 |

| David Lantz | Wells Fargo | Lowers | Overweight | $290.00 | $310.00 |

| Alexander Potter | Piper Sandler | Raises | Overweight | $230.00 | $225.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Carvana. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Carvana compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Carvana's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Carvana's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Carvana analyst ratings.

Get to Know Carvana Better

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Carvana's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Carvana's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 38.26%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Carvana's net margin is impressive, surpassing industry averages. With a net margin of 5.1%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Carvana's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 15.63% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Carvana's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.49%, the company showcases efficient use of assets and strong financial health.

Debt Management: Carvana's debt-to-equity ratio is below the industry average. With a ratio of 4.02, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CVNA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | DA Davidson | Maintains | Neutral | |

| Feb 2022 | Stephens & Co. | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings