Breaking Down Virtus Inv: 5 Analysts Share Their Views

Virtus Inv (NYSE:VRTS) has been analyzed by 5 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 0 | 4 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 2 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 2 | 0 |

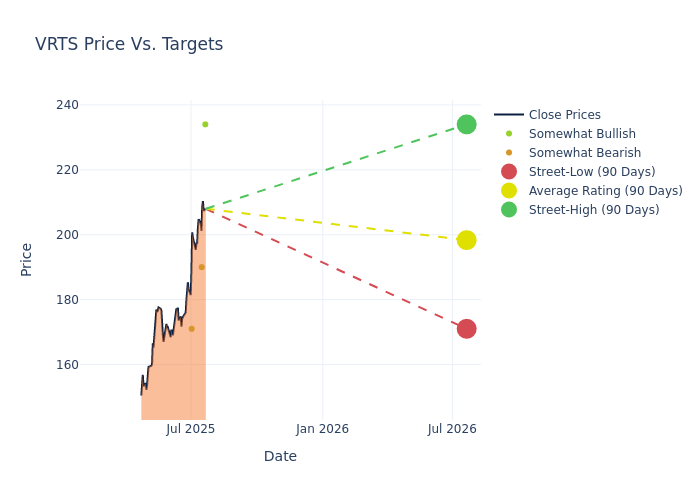

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $179.4, along with a high estimate of $234.00 and a low estimate of $150.00. This current average has increased by 10.6% from the previous average price target of $162.20.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Virtus Inv. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Crispin Love | Piper Sandler | Raises | Overweight | $234.00 | $211.00 |

| Benjamin Budish | Barclays | Raises | Underweight | $190.00 | $150.00 |

| Michael Cyprys | Morgan Stanley | Raises | Underweight | $171.00 | $152.00 |

| Michael Cyprys | Morgan Stanley | Raises | Underweight | $152.00 | $149.00 |

| Benjamin Budish | Barclays | Raises | Underweight | $150.00 | $149.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Virtus Inv. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Virtus Inv compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Virtus Inv's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Virtus Inv's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Virtus Inv analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Virtus Inv Better

Virtus Investment Partners Inc provides investment management and related services to institutions and individuals. It uses a multi-manager, multi-style approach, offering investment strategies from investment managers, each having its distinct investment style, autonomous investment process, and individual brand, as well as from select unaffiliated managers for certain funds. Through its multi-manager model, the group provides investment managers with distribution, business, and operational support. The Company operates in one business segment, namely as an asset manager providing investment management and related services for individual and institutional clients.

Virtus Inv's Economic Impact: An Analysis

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Challenges: Virtus Inv's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -1.91%. This indicates a decrease in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: Virtus Inv's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 13.21%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Virtus Inv's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 3.2%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.75%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Virtus Inv's debt-to-equity ratio stands notably higher than the industry average, reaching 2.62. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for VRTS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Aug 2021 | Morgan Stanley | Upgrades | Equal-Weight | Overweight |

| Jul 2021 | Morgan Stanley | Maintains | Equal-Weight | |

| Jul 2021 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings