What Analysts Are Saying About Crane Stock

Crane (NYSE:CR) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

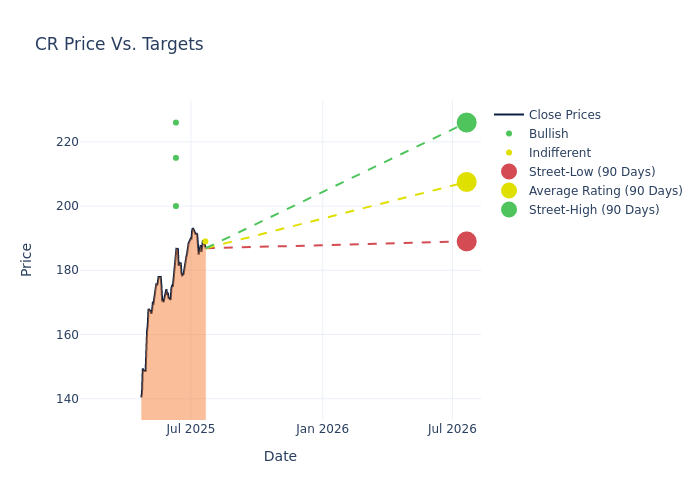

Analysts have recently evaluated Crane and provided 12-month price targets. The average target is $195.0, accompanied by a high estimate of $226.00 and a low estimate of $150.00. This current average reflects an increase of 12.18% from the previous average price target of $173.83.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive Crane is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nathan Jones | Stifel | Raises | Hold | $189.00 | $165.00 |

| Matt Summerville | DA Davidson | Maintains | Buy | $200.00 | $200.00 |

| Damian Karas | UBS | Raises | Buy | $215.00 | $190.00 |

| Scott Deuschle | Deutsche Bank | Raises | Buy | $226.00 | $187.00 |

| Nathan Jones | Stifel | Raises | Hold | $150.00 | $144.00 |

| Damian Karas | UBS | Raises | Buy | $190.00 | $157.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Crane. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Crane compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Crane's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Crane's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Crane analyst ratings.

Get to Know Crane Better

Crane is a diversified industrial firm that manufactures a broad range of products, including valves, pumps, aerospace components, and fiberglass-reinforced plastic panels. Its business is organized into two segments: aerospace and electronics, and process flow technologies. Crane generated approximately $2.1 billion in revenue in 2024.

A Deep Dive into Crane's Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Crane's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 9.29% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 19.21%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 6.31%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Crane's ROA excels beyond industry benchmarks, reaching 4.07%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.15, Crane adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Dec 2021 | Morgan Stanley | Initiates Coverage On | Equal-Weight | |

| Sep 2021 | BMO Capital | Upgrades | Market Perform | Outperform |

Posted-In: BZI-AARAnalyst Ratings