Preview: Crane Holdings's Earnings

Crane Holdings (NYSE:CR) will release its quarterly earnings report on Monday, 2025-07-28. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Crane Holdings to report an earnings per share (EPS) of $1.33.

The announcement from Crane Holdings is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

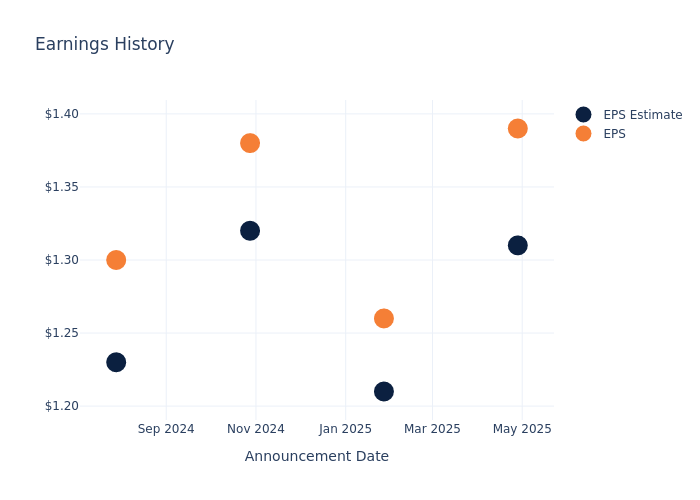

Historical Earnings Performance

The company's EPS beat by $0.08 in the last quarter, leading to a 6.86% increase in the share price on the following day.

Here's a look at Crane Holdings's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.31 | 1.21 | 1.32 | 1.23 |

| EPS Actual | 1.39 | 1.26 | 1.38 | 1.30 |

| Price Change % | 7.000000000000001% | 12.0% | 4.0% | -5.0% |

Performance of Crane Holdings Shares

Shares of Crane Holdings were trading at $189.17 as of July 24. Over the last 52-week period, shares are up 19.11%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Crane Holdings

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Crane Holdings.

Analysts have given Crane Holdings a total of 6 ratings, with the consensus rating being Buy. The average one-year price target is $195.0, indicating a potential 3.08% upside.

Comparing Ratings with Peers

The analysis below examines the analyst ratings and average 1-year price targets of Stanley Black & Decker, RBC Bearings and Nordson, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Stanley Black & Decker, with an average 1-year price target of $74.71, suggesting a potential 60.51% downside.

- Analysts currently favor an Buy trajectory for RBC Bearings, with an average 1-year price target of $423.4, suggesting a potential 123.82% upside.

- Analysts currently favor an Outperform trajectory for Nordson, with an average 1-year price target of $251.67, suggesting a potential 33.04% upside.

Peer Metrics Summary

The peer analysis summary presents essential metrics for Stanley Black & Decker, RBC Bearings and Nordson, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Crane | Buy | 9.29% | $237.60M | 6.31% |

| Stanley Black & Decker | Neutral | -3.23% | $1.12B | 1.03% |

| RBC Bearings | Buy | 5.80% | $193.40M | 2.44% |

| Nordson | Outperform | 4.96% | $373.90M | 3.85% |

Key Takeaway:

Crane Holdings ranks highest in Gross Profit among its peers. It is in the middle for Revenue Growth and Return on Equity.

About Crane Holdings

Crane is a diversified industrial firm that manufactures a broad range of products, including valves, pumps, aerospace components, and fiberglass-reinforced plastic panels. Its business is organized into two segments: aerospace and electronics, and process flow technologies. Crane generated approximately $2.1 billion in revenue in 2024.

A Deep Dive into Crane Holdings's Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Crane Holdings's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 9.29%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Crane Holdings's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 19.21% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 6.31%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Crane Holdings's ROA stands out, surpassing industry averages. With an impressive ROA of 4.07%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Crane Holdings's debt-to-equity ratio is below the industry average. With a ratio of 0.15, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Crane Holdings visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.