What Analysts Are Saying About Amgen Stock

Analysts' ratings for Amgen (NASDAQ:AMGN) over the last quarter vary from bullish to bearish, as provided by 8 analysts.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 3 | 0 | 0 |

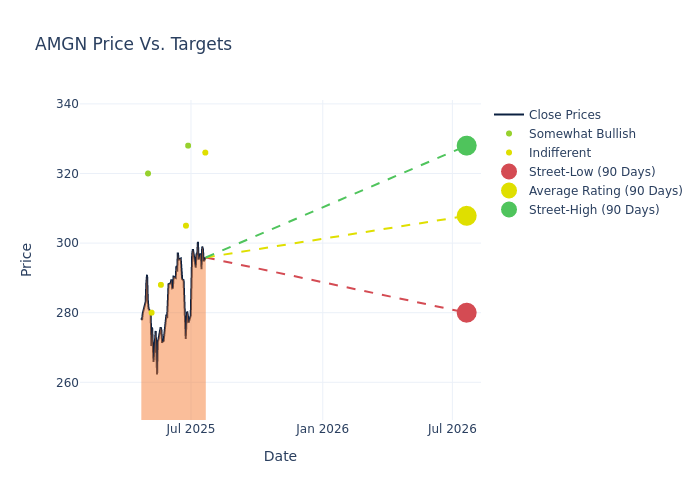

Analysts have recently evaluated Amgen and provided 12-month price targets. The average target is $311.25, accompanied by a high estimate of $328.00 and a low estimate of $280.00. This current average reflects an increase of 1.1% from the previous average price target of $307.86.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Amgen. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Trung Huynh | UBS | Raises | Neutral | $326.00 | $315.00 |

| David Amsellem | Piper Sandler | Maintains | Overweight | $328.00 | $328.00 |

| Carter Gould | Cantor Fitzgerald | Maintains | Neutral | $305.00 | $305.00 |

| Vamil Divan | Guggenheim | Announces | Neutral | $288.00 | - |

| David Amsellem | Piper Sandler | Lowers | Overweight | $328.00 | $329.00 |

| Salim Syed | Mizuho | Raises | Neutral | $280.00 | $235.00 |

| Trung Huynh | UBS | Lowers | Neutral | $315.00 | $319.00 |

| Gregory Renza | RBC Capital | Lowers | Outperform | $320.00 | $324.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Amgen. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Amgen compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Amgen's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Amgen's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Amgen analyst ratings.

Get to Know Amgen Better

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drugs Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx Pharmaceuticals bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brought several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Amgen's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Amgen's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 9.43%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 21.23%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 28.63%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Amgen's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.91% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Amgen's debt-to-equity ratio stands notably higher than the industry average, reaching 9.24. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AMGN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Wells Fargo | Maintains | Equal-Weight | |

| Feb 2022 | Barclays | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings