10 Analysts Have This To Say About Bumble

In the latest quarter, 10 analysts provided ratings for Bumble (NASDAQ:BMBL), showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 5 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 0 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

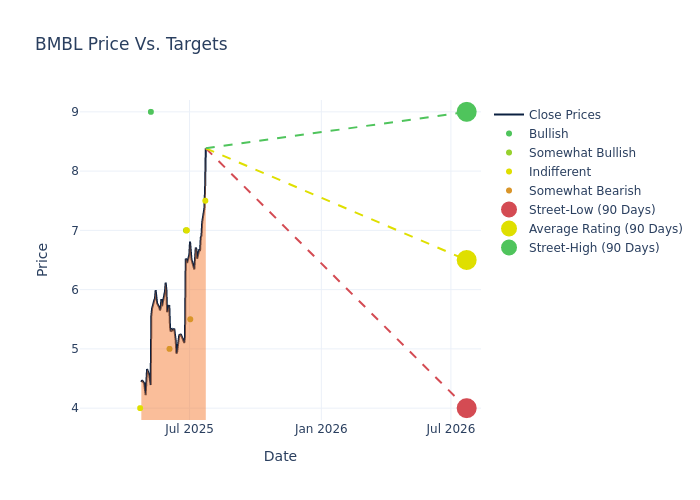

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $6.38, along with a high estimate of $9.00 and a low estimate of $4.80. This upward trend is apparent, with the current average reflecting a 10.19% increase from the previous average price target of $5.79.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Bumble among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kunal Madhukar | UBS | Raises | Neutral | $7.50 | $6.00 |

| Curtis Nagle | B of A Securities | Raises | Underperform | $5.50 | $5.25 |

| Ygal Arounian | Citigroup | Raises | Neutral | $7.00 | $4.80 |

| Ken Gawrelski | Wells Fargo | Raises | Equal-Weight | $7.00 | $5.00 |

| Brad Erickson | RBC Capital | Raises | Outperform | $7.00 | $5.00 |

| Cory Carpenter | JP Morgan | Maintains | Underweight | $5.00 | $5.00 |

| Kunal Madhukar | UBS | Raises | Neutral | $6.00 | $5.00 |

| Brad Erickson | RBC Capital | Lowers | Outperform | $5.00 | $7.00 |

| Alexandra Steiger | Goldman Sachs | Raises | Buy | $9.00 | $8.00 |

| Ygal Arounian | Citigroup | Lowers | Neutral | $4.80 | $6.80 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Bumble. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Bumble compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Bumble's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Bumble's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Bumble analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Bumble: A Closer Look

Bumble Inc is engaged in offering online dating services. The platform enables people to connect and build healthy and equitable relationships on their own terms. The company operates two apps, Bumble and Badoo, where users come every month to discover new people and connect. The company Operates in USA and also Internationally such as United Kingdom, Czech Republic, and others with maximum of revenue from Other Countries.

Bumble: Financial Performance Dissected

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Negative Revenue Trend: Examining Bumble's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -7.72% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 5.44%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Bumble's ROE stands out, surpassing industry averages. With an impressive ROE of 1.64%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Bumble's ROA excels beyond industry benchmarks, reaching 0.53%. This signifies efficient management of assets and strong financial health.

Debt Management: Bumble's debt-to-equity ratio is below the industry average. With a ratio of 0.77, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BMBL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Hold | |

| Mar 2022 | Susquehanna | Maintains | Positive | |

| Mar 2022 | Goldman Sachs | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings