Forecasting The Future: 10 Analyst Projections For Birkenstock Holding

Across the recent three months, 10 analysts have shared their insights on Birkenstock Holding (NYSE:BIRK), expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 5 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 4 | 5 | 0 | 0 | 0 |

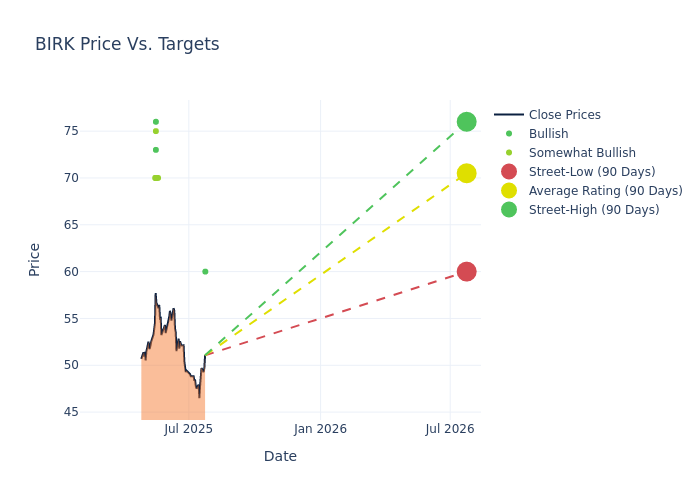

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $70.6, a high estimate of $76.00, and a low estimate of $60.00. Surpassing the previous average price target of $67.20, the current average has increased by 5.06%.

Interpreting Analyst Ratings: A Closer Look

The standing of Birkenstock Holding among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Louise Singlehurst | Goldman Sachs | Maintains | Buy | $60.00 | $60.00 |

| Michael Binetti | Evercore ISI Group | Raises | Outperform | $70.00 | $65.00 |

| Jay Sole | UBS | Raises | Buy | $76.00 | $72.00 |

| Jim Duffy | Stifel | Raises | Buy | $70.00 | $62.00 |

| Simeon Siegel | BMO Capital | Raises | Outperform | $75.00 | $70.00 |

| Lorraine Hutchinson | B of A Securities | Raises | Buy | $73.00 | $70.00 |

| Mark Altschwager | Baird | Raises | Outperform | $70.00 | $65.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $70.00 | $70.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $70.00 | $70.00 |

| Jay Sole | UBS | Raises | Buy | $72.00 | $68.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Birkenstock Holding. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Birkenstock Holding compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Birkenstock Holding's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Birkenstock Holding's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Birkenstock Holding analyst ratings.

Delving into Birkenstock Holding's Background

Birkenstock Holding PLC is a company that manufactures and sells footbed-based products, including sandals, closed-toe silhouettes, and other products, such as skincare and accessories, for everyday, leisure, and work. It sells its products through two main channels: business-to-business (B2B) which comprises sales made to established third-party store networks, and direct-to-consumer (DTC) which comprises sales made on globally owned online stores through the Birkenstock.com domain and sales made in Birkenstock retail stores. The company's reportable segments are based on its regional hubs and include: the Americas which is also its key revenue-generating segment; Europe; and Australia, Japan, India, China, and the United Arab Emirates (APMA).

Birkenstock Holding: Financial Performance Dissected

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Birkenstock Holding's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 19.34%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 18.3%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.79%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.1%, the company showcases effective utilization of assets.

Debt Management: Birkenstock Holding's debt-to-equity ratio is below the industry average. With a ratio of 0.49, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-AARAnalyst Ratings