Deep Dive Into Lennox Intl Stock: Analyst Perspectives (6 Ratings)

Analysts' ratings for Lennox Intl (NYSE:LII) over the last quarter vary from bullish to bearish, as provided by 6 analysts.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 1 | 2 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 1 | 0 |

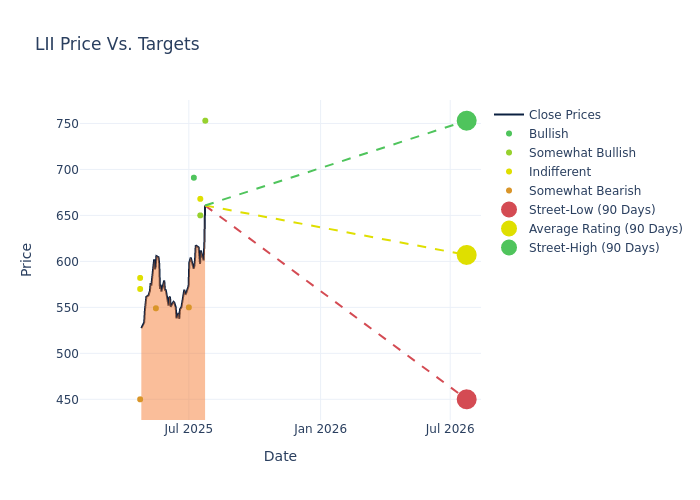

Analysts have recently evaluated Lennox Intl and provided 12-month price targets. The average target is $643.5, accompanied by a high estimate of $753.00 and a low estimate of $549.00. This current average has increased by 11.27% from the previous average price target of $578.33.

Interpreting Analyst Ratings: A Closer Look

The standing of Lennox Intl among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Raises | Overweight | $753.00 | $696.00 |

| Timothy Wojs | Baird | Raises | Neutral | $668.00 | $600.00 |

| Noah Kaye | Oppenheimer | Raises | Outperform | $650.00 | $600.00 |

| Joe Ritchie | Goldman Sachs | Raises | Buy | $691.00 | $619.00 |

| Joseph O'Dea | Wells Fargo | Raises | Underweight | $550.00 | $500.00 |

| Stephen Tusa | JP Morgan | Raises | Underweight | $549.00 | $455.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Lennox Intl. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Lennox Intl compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Lennox Intl's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Lennox Intl's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Lennox Intl analyst ratings.

Delving into Lennox Intl's Background

Lennox International manufactures and distributes heating, ventilating, air conditioning, and refrigeration products to replacement (75% of sales) and new construction (25% of sales) markets. In fiscal 2024, residential HVAC was 67% of sales and commercial HVAC and Heatcraft refrigeration was 33% of sales. The company goes to market with multiple brands, but Lennox is the company's flagship HVAC brand. The Texas-based company is focused on North America after the sale of its European HVAC and refrigeration businesses in late 2023.

Unraveling the Financial Story of Lennox Intl

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Over the 3M period, Lennox Intl showcased positive performance, achieving a revenue growth rate of 2.44% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 11.22%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Lennox Intl's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 14.13%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Lennox Intl's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.47% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Lennox Intl's debt-to-equity ratio stands notably higher than the industry average, reaching 1.75. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for LII

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Upgrades | Underweight | Equal-Weight |

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Dec 2021 | Mizuho | Initiates Coverage On | Underperform |

Posted-In: BZI-AARAnalyst Ratings