Expert Outlook: Newmark Group Through The Eyes Of 4 Analysts

During the last three months, 4 analysts shared their evaluations of Newmark Group (NASDAQ:NMRK), revealing diverse outlooks from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

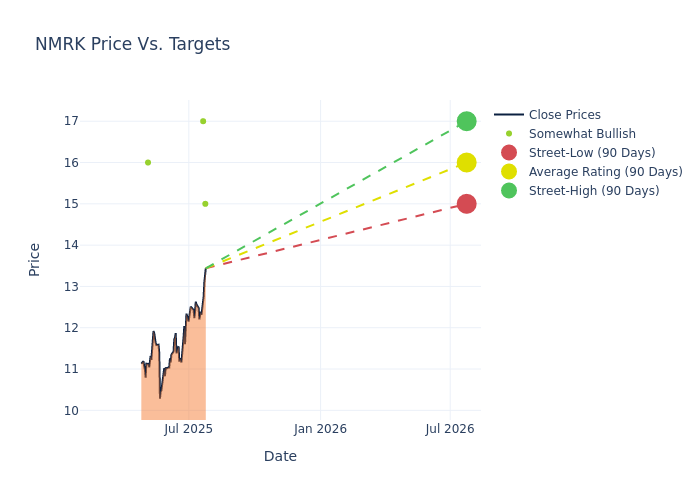

Analysts have recently evaluated Newmark Group and provided 12-month price targets. The average target is $15.5, accompanied by a high estimate of $17.00 and a low estimate of $14.00. This current average represents a 2.08% decrease from the previous average price target of $15.83.

Investigating Analyst Ratings: An Elaborate Study

A comprehensive examination of how financial experts perceive Newmark Group is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jade Rahmani | Keefe, Bruyette & Woods | Raises | Outperform | $15.00 | $14.00 |

| Mitch Germain | JMP Securities | Announces | Market Outperform | $17.00 | - |

| Alexander Goldfarb | Piper Sandler | Lowers | Overweight | $16.00 | $19.00 |

| Jade Rahmani | Keefe, Bruyette & Woods | Lowers | Outperform | $14.00 | $14.50 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Newmark Group. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Newmark Group compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Newmark Group's stock. This analysis reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Newmark Group's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Newmark Group analyst ratings.

Discovering Newmark Group: A Closer Look

Newmark Group Inc is a commercial real estate advisory firm. It offers services, including leasing and corporate advisory services, investment sales, commercial mortgage brokerage, appraisal and valuation, project management, and property, among others. Newmark offers a diverse array of integrated services and products designed to meet the full needs of both real estate investors/owners and occupiers. The company provides real estate strategic consulting and systems integration services to CFI's clients including many Fortune and Forbes companies, owner-occupiers, government agencies, healthcare, and higher education clients.

Financial Insights: Newmark Group

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Newmark Group displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 21.77%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Newmark Group's net margin is impressive, surpassing industry averages. With a net margin of -1.32%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Newmark Group's ROE stands out, surpassing industry averages. With an impressive ROE of -0.69%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Newmark Group's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.18% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Newmark Group's debt-to-equity ratio stands notably higher than the industry average, reaching 1.67. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for NMRK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wolfe Research | Downgrades | Outperform | Peer Perform |

| Nov 2021 | Raymond James | Maintains | Outperform | |

| Aug 2021 | Raymond James | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings