Deep Dive Into AT&T Stock: Analyst Perspectives (8 Ratings)

AT&T (NYSE:T) underwent analysis by 8 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 0 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 3 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

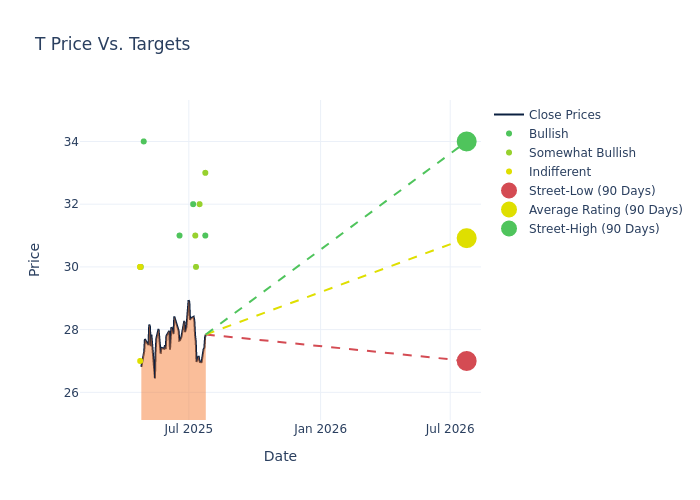

Analysts have recently evaluated AT&T and provided 12-month price targets. The average target is $31.75, accompanied by a high estimate of $34.00 and a low estimate of $30.00. This upward trend is apparent, with the current average reflecting a 4.1% increase from the previous average price target of $30.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

The analysis of recent analyst actions sheds light on the perception of AT&T by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Frank Louthan | Raymond James | Raises | Strong Buy | $31.00 | $30.00 |

| Sebastiano Petti | JP Morgan | Raises | Overweight | $33.00 | $31.00 |

| Simon Flannery | Morgan Stanley | Raises | Overweight | $32.00 | $31.00 |

| Kevin Fisk | Scotiabank | Raises | Sector Outperform | $30.00 | $29.50 |

| Eric Luebchow | Wells Fargo | Raises | Overweight | $31.00 | $30.00 |

| Michael Funk | B of A Securities | Announces | Buy | $32.00 | - |

| John Hodulik | UBS | Raises | Buy | $31.00 | $30.00 |

| Ivan Feinseth | Tigress Financial | Raises | Buy | $34.00 | $32.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to AT&T. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of AT&T compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of AT&T's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into AT&T's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on AT&T analyst ratings.

Delving into AT&T's Background

The wireless business contributes nearly 70% of AT&T's revenue. The firm is the third-largest US wireless carrier, connecting 73 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 15% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access, serving 14 million customers. AT&T also has a sizable presence in Mexico, with 24 million customers, but this business only accounts for 3% of revenue. The firm has agreed to sell its 70% equity stake in satellite television provider DirecTV to its partner, private equity firm TPG.

A Deep Dive into AT&T's Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3M period, AT&T showcased positive performance, achieving a revenue growth rate of 1.99% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: AT&T's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.35%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): AT&T's ROE excels beyond industry benchmarks, reaching 4.22%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): AT&T's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.11%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.38, caution is advised due to increased financial risk.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for T

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | TD Securities | Downgrades | Buy | Hold |

| Feb 2022 | JP Morgan | Upgrades | Neutral | Overweight |

| Feb 2022 | Raymond James | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings