Beyond The Numbers: 8 Analysts Discuss Ameriprise Finl Stock

Ameriprise Finl (NYSE:AMP) underwent analysis by 8 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 4 | 2 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 2 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 0 | 0 |

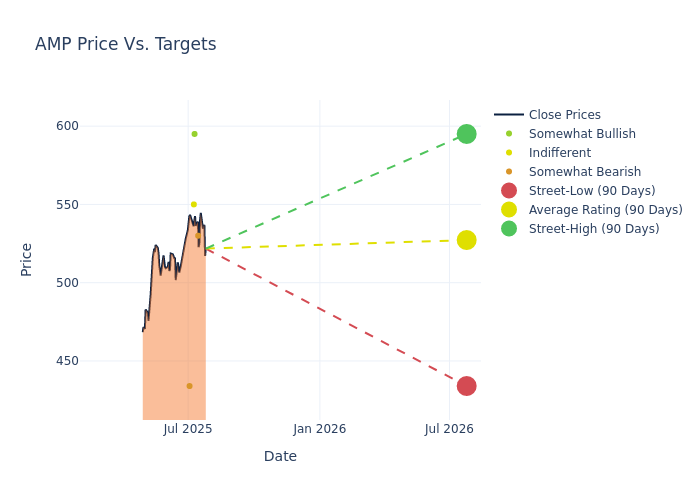

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $520.75, with a high estimate of $595.00 and a low estimate of $434.00. This current average reflects an increase of 4.73% from the previous average price target of $497.25.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Ameriprise Finl's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Cyprys | Morgan Stanley | Raises | Underweight | $530.00 | $462.00 |

| Arun Viswanathan | RBC Capital | Raises | Outperform | $595.00 | $565.00 |

| Ryan Krueger | Keefe, Bruyette & Woods | Raises | Market Perform | $550.00 | $520.00 |

| John Barnidge | Piper Sandler | Raises | Underweight | $434.00 | $423.00 |

| Michael Cyprys | Morgan Stanley | Raises | Equal-Weight | $462.00 | $428.00 |

| Ryan Krueger | Keefe, Bruyette & Woods | Raises | Market Perform | $520.00 | $510.00 |

| Kenneth Lee | RBC Capital | Raises | Outperform | $565.00 | $550.00 |

| Ryan Krueger | Keefe, Bruyette & Woods | Lowers | Market Perform | $510.00 | $520.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Ameriprise Finl. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ameriprise Finl compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Ameriprise Finl's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Ameriprise Finl's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Ameriprise Finl analyst ratings.

About Ameriprise Finl

Ameriprise Financial is a major player in the US market for asset and wealth management, with around $1.5 trillion in total assets under management and administration at the end of 2024. With about 10,500 advisors, Ameriprise has one of the largest branded advisor networks in the industry. About 80% of the company's revenue comes from its asset and wealth management segments. Ameriprise has reduced its exposure to insurance with the sale of its auto and home insurance business in 2019 and discontinuing the sale of proprietary fixed annuities in 2020.

Financial Insights: Ameriprise Finl

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3M period, Ameriprise Finl showcased positive performance, achieving a revenue growth rate of 5.02% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Ameriprise Finl's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 13.39%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ameriprise Finl's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.94% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Ameriprise Finl's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.32%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Ameriprise Finl's debt-to-equity ratio is below the industry average at 1.14, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AMP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Piper Sandler | Downgrades | Overweight | Neutral |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings