Expert Outlook: SouthState Through The Eyes Of 7 Analysts

7 analysts have shared their evaluations of SouthState (NYSE:SSB) during the recent three months, expressing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 0 | 0 | 0 |

| Last 30D | 2 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

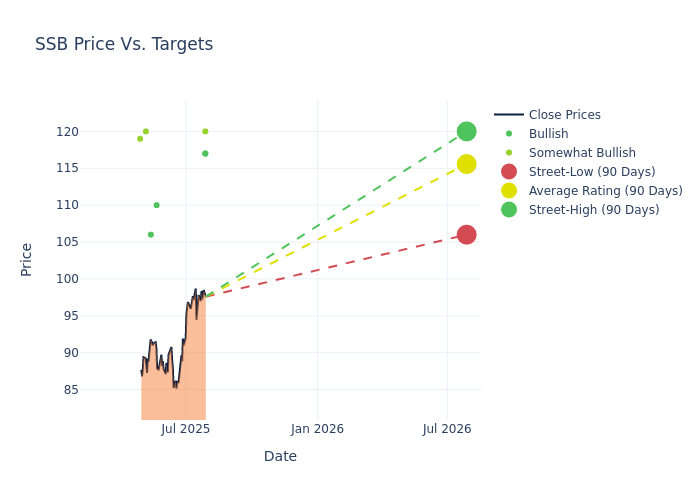

The 12-month price targets, analyzed by analysts, offer insights with an average target of $115.29, a high estimate of $120.00, and a low estimate of $106.00. A 2.3% drop is evident in the current average compared to the previous average price target of $118.00.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive SouthState. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ben Gerlinger | Citigroup | Raises | Buy | $117.00 | $113.00 |

| Gary Tenner | DA Davidson | Raises | Buy | $117.00 | $115.00 |

| Jared Shaw | Barclays | Raises | Overweight | $120.00 | $117.00 |

| Jared Shaw | Barclays | Raises | Overweight | $117.00 | $115.00 |

| David Chiaverini | Jefferies | Announces | Buy | $110.00 | - |

| Brandon King | Truist Securities | Announces | Buy | $106.00 | - |

| Catherine Mealor | Keefe, Bruyette & Woods | Lowers | Outperform | $120.00 | $130.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to SouthState. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of SouthState compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of SouthState's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of SouthState's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on SouthState analyst ratings.

Unveiling the Story Behind SouthState

SouthState Corp is a United States-based bank holding company. It provides a wide range of services and products to its customers through a wholly-owned bank subsidiary, South State Bank. The Bank provides retail and commercial banking services, mortgage lending services, trust and investment services, and consumer finance loans through financial centers in Alabama, Florida, Georgia, North Carolina, South Carolina, and Virginia. These services include demand, time and savings deposits, lending and credit card servicing, ATM processing, and wealth management and trust services.

Understanding the Numbers: SouthState's Finances

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, SouthState showcased positive performance, achieving a revenue growth rate of 5.41% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: SouthState's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 32.38% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.47%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): SouthState's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.33% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: SouthState's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.12.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SSB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Stephens & Co. | Maintains | Equal-Weight | |

| Jan 2022 | Raymond James | Maintains | Outperform | |

| Dec 2021 | Raymond James | Upgrades | Market Perform | Outperform |

Posted-In: BZI-AARAnalyst Ratings