Forecasting The Future: 4 Analyst Projections For American Tower

During the last three months, 4 analysts shared their evaluations of American Tower (NYSE:AMT), revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 0 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

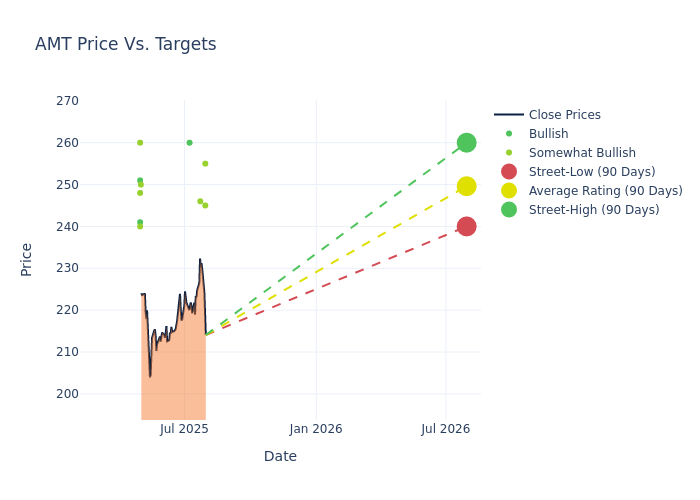

The 12-month price targets, analyzed by analysts, offer insights with an average target of $251.5, a high estimate of $260.00, and a low estimate of $245.00. Observing a 3.39% increase, the current average has risen from the previous average price target of $243.25.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of American Tower among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Choe | JP Morgan | Raises | Overweight | $255.00 | $250.00 |

| Ari Klein | BMO Capital | Lowers | Outperform | $245.00 | $250.00 |

| Tim Long | Barclays | Raises | Overweight | $246.00 | $223.00 |

| Batya Levi | UBS | Raises | Buy | $260.00 | $250.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to American Tower. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of American Tower compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of American Tower's stock. This analysis reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into American Tower's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on American Tower analyst ratings.

About American Tower

American Tower owns and operates more than 220,000 cell towers throughout the US, Asia, Latin America, Europe, and Africa. It also owns and/or operates 28 data centers in 10 US markets after acquiring CoreSite. On its towers, the company has a very concentrated customer base, with most revenue in each market being generated by just the top few mobile carriers. The company operates more than 40,000 towers in the US, which accounted for almost half of the company's total revenue in 2023. Outside the US, American Tower operates over 75,000 towers in India, almost 50,000 towers in Latin America (dominated by Brazil), 30,000 towers in Europe, and nearly 25,000 towers in Africa. American Tower operates as a REIT.

Unraveling the Financial Story of American Tower

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: American Tower's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 2.0%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 19.07%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 14.13%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): American Tower's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.79%, the company showcases efficient use of assets and strong financial health.

Debt Management: American Tower's debt-to-equity ratio stands notably higher than the industry average, reaching 12.56. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AMT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Maintains | Overweight | |

| Mar 2022 | Barclays | Maintains | Overweight | |

| Mar 2022 | Credit Suisse | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings