What's Next: Stanley Black & Decker's Earnings Preview

Stanley Black & Decker (NYSE:SWK) is set to give its latest quarterly earnings report on Tuesday, 2025-07-29. Here's what investors need to know before the announcement.

Analysts estimate that Stanley Black & Decker will report an earnings per share (EPS) of $0.40.

Investors in Stanley Black & Decker are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

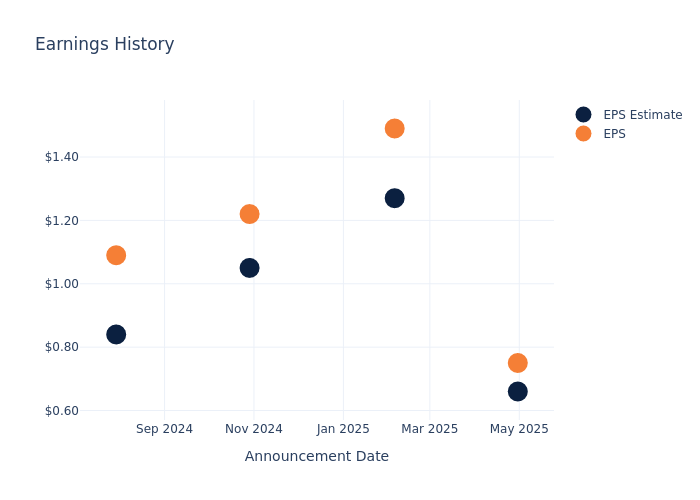

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.09, leading to a 1.8% drop in the share price the following trading session.

Here's a look at Stanley Black & Decker's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.66 | 1.27 | 1.05 | 0.84 |

| EPS Actual | 0.75 | 1.49 | 1.22 | 1.09 |

| Price Change % | -2.0% | 0.0% | -0.0% | -0.0% |

Tracking Stanley Black & Decker's Stock Performance

Shares of Stanley Black & Decker were trading at $73.9 as of July 25. Over the last 52-week period, shares are down 30.03%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Insights Shared by Analysts on Stanley Black & Decker

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Stanley Black & Decker.

Analysts have given Stanley Black & Decker a total of 7 ratings, with the consensus rating being Neutral. The average one-year price target is $74.71, indicating a potential 1.1% upside.

Comparing Ratings Among Industry Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Crane, RBC Bearings and Nordson, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Crane, with an average 1-year price target of $195.0, suggesting a potential 163.87% upside.

- Analysts currently favor an Buy trajectory for RBC Bearings, with an average 1-year price target of $423.4, suggesting a potential 472.94% upside.

- Analysts currently favor an Outperform trajectory for Nordson, with an average 1-year price target of $251.67, suggesting a potential 240.55% upside.

Analysis Summary for Peers

Within the peer analysis summary, vital metrics for Crane, RBC Bearings and Nordson are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Stanley Black & Decker | Neutral | -3.23% | $1.12B | 1.03% |

| Crane | Buy | 9.29% | $237.60M | 6.31% |

| RBC Bearings | Buy | 5.80% | $193.40M | 2.44% |

| Nordson | Outperform | 4.96% | $373.90M | 3.85% |

Key Takeaway:

Stanley Black & Decker ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, it is at the bottom.

Delving into Stanley Black & Decker's Background

Stanley Black & Decker Inc is a manufacturer of hand and power tools. The company operates in two reportable segments namely Tools and Outdoor and Industrial. It generates maximum revenue from the Tools and Outdoor segment. The Tools and Outdoor segment is comprised of the Power Tools Group (PTG), Hand Tools, Accessories and Storage (HTAS), and Outdoor Power Equipment (Outdoor) businesses. Geographically, the company generates revenue from the United States, Canada, Other Americas, Europe, and Asia. It derives a majority of its revenue from the United States.

Stanley Black & Decker's Financial Performance

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: Stanley Black & Decker's revenue growth over 3 months faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -3.23%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Stanley Black & Decker's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 2.41%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Stanley Black & Decker's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.03%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Stanley Black & Decker's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.41%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Stanley Black & Decker's debt-to-equity ratio stands notably higher than the industry average, reaching 0.76. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Stanley Black & Decker visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.