The Analyst Verdict: Bentley Systems In The Eyes Of 9 Experts

In the last three months, 9 analysts have published ratings on Bentley Systems (NASDAQ:BSY), offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 6 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 3 | 1 | 0 | 0 |

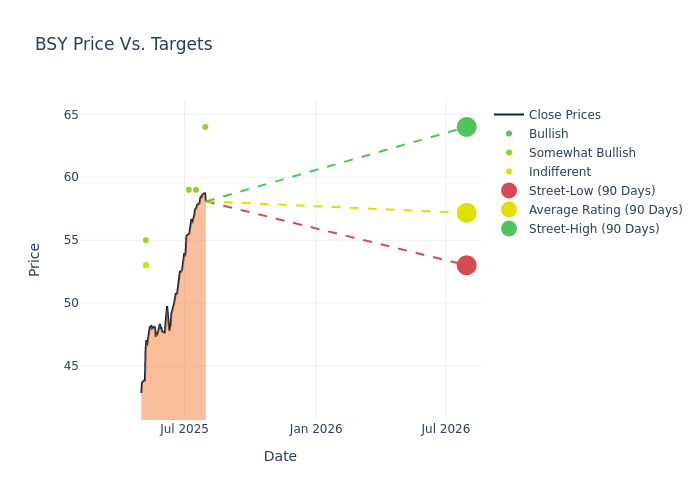

Insights from analysts' 12-month price targets are revealed, presenting an average target of $55.78, a high estimate of $64.00, and a low estimate of $50.00. This upward trend is apparent, with the current average reflecting a 4.81% increase from the previous average price target of $53.22.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Bentley Systems among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joe Vruwink | Baird | Raises | Outperform | $64.00 | $54.00 |

| Kristen Owen | Oppenheimer | Raises | Outperform | $59.00 | $50.00 |

| Jason Celino | Keybanc | Raises | Overweight | $59.00 | $56.00 |

| Taylor McGinnis | UBS | Raises | Neutral | $53.00 | $48.00 |

| Matthew Hedberg | RBC Capital | Raises | Outperform | $55.00 | $53.00 |

| Jason Celino | Keybanc | Raises | Overweight | $56.00 | $54.00 |

| Kristen Owen | Oppenheimer | Raises | Outperform | $50.00 | $49.00 |

| Blair Abernethy | Rosenblatt | Maintains | Buy | $53.00 | $53.00 |

| Blair Abernethy | Rosenblatt | Lowers | Buy | $53.00 | $62.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Bentley Systems. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Bentley Systems compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Bentley Systems's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Bentley Systems's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Bentley Systems analyst ratings.

Get to Know Bentley Systems Better

Bentley Systems is a software vendor that caters to engineers, architects, constructors, and geospatial professionals by enabling design, modeling, simulation, project management, and data management of infrastructure assets. The firm delivers solutions via the cloud, desktop, and hybrid environments. While Bentley is relatively small in comparison with peers like Autodesk, it shines in core specialty areas, like bridge or rail design, as opposed to being more broad-based in its applications. Bentley's largest end market is the public works and utilities sector, which represents approximately two thirds of revenue.

Financial Milestones: Bentley Systems's Journey

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Bentley Systems's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 9.7%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Bentley Systems's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 24.65%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Bentley Systems's ROE excels beyond industry benchmarks, reaching 8.54%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.69%, the company showcases effective utilization of assets.

Debt Management: Bentley Systems's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.17, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BSY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | RBC Capital | Maintains | Outperform | |

| Mar 2022 | Keybanc | Maintains | Overweight | |

| Aug 2021 | Keybanc | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings